- Joined

- Jun 30, 2024

- Messages

- 1,851

- Likes

- 23,520

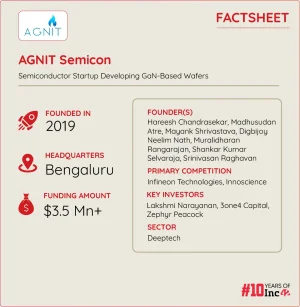

Built from the ground up with proprietary technology and supported by 15+ years of research by top IISc professors and students, AGNIT will be the first to utilise The Gallium Nitride Ecosystem Enabling Centre and Incubator’s (GEECI) infrastructure for GaN wafer and radio frequency (RF) device production.

As AGNIT is buckling up for the reliability check of its devices and plans to make about 1 Lakh devices in the next 12-24 months, it recently raised $3.5 Mn in a funding round co-led by 3one4 Capital and Zephyr Peacock, with the participation from Cognizant’s Narayanan.

China's Haier Group plans JV with JSW Group envisaging Rs 1000 crore investment

Haier Group, a leading Chinese appliances manufacturer, has plans to set up a joint venture with India's JSW Group envisaging a proposed investment of Rs 1,000 crore, sources said.

China's Haier Group plans JV with JSW Group envisaging Rs 1000 crore investment

Haier Group, a leading Chinese appliances manufacturer, has plans to set up a joint venture with India's JSW Group envisaging a proposed investment of Rs 1,000 crore, sources said.www.zeebiz.com

These rumors have been circulating for over a year now. First it was a JV with some chong ev maker (no, I am not referring to their deal with MG), then it was another JV with some chong component maker and now this. The previous rumors are yet to materialize (mostly coz the gormint is not open to more chong exposure to domestic industries with electronics being a notable exception).jindal is the go to guy for chini JVs is it?

MG motors a few months back and now this.

jindal is the go to guy for chini JVs is it?

MG motors a few months back and now this.

why are these jokers typing up with cheenis for consumer goods? Haier should be allowed to invest on their own and the govt should tell jindal to come up with their own investment, or boost investment into local companies to expand like Havells or Blue Star, or get lost. Very typical dhando business. For EVs it makes sense, but for consumer goods?

These rumors have been circulating for over a year now. First it was a JV with some chong ev maker (no, I am not referring to their deal with MG), then it was another JV with some chong component maker and now this. The previous rumors are yet to materialize (mostly coz the gormint is not open to more chong exposure to domestic industries with electronics being a notable exception).

Should we have a separate white goods thread ? This one is getting way too cluttered.China's Haier Group plans JV with JSW Group envisaging Rs 1000 crore investment

Haier Group, a leading Chinese appliances manufacturer, has plans to set up a joint venture with India's JSW Group envisaging a proposed investment of Rs 1,000 crore, sources said.

China's Haier Group plans JV with JSW Group envisaging Rs 1000 crore investment

Haier Group, a leading Chinese appliances manufacturer, has plans to set up a joint venture with India's JSW Group envisaging a proposed investment of Rs 1,000 crore, sources said.www.zeebiz.com

Should we have a separate white goods thread ? This one is getting way too cluttered.

why are these jokers typing up with cheenis for consumer goods? Haier should be allowed to invest on their own and the govt should tell jindal to come up with their own investment, or boost investment into local companies to expand like Havells or Blue Star, or get lost. Very typical dhando business. For EVs it makes sense, but for consumer goods?

These rumors have been circulating for over a year now. First it was a JV with some chong ev maker (no, I am not referring to their deal with MG), then it was another JV with some chong component maker and now this. The previous rumors are yet to materialize (mostly coz the gormint is not open to more chong exposure to domestic industries with electronics being a notable exception).

Tech parner. Hiranandani has built a subsidiary called Tarq semicon for it. Can be taken seriously as he also created Yotta for data centre business and has actually delivered on commitments.Anymore info about the Hiranandani venture? is Renesas really a JV partner or tech partner?

Tech parner. Hiranandani has built a subsidiary called Tarq semicon for it. Can be taken seriously as he also created Yotta for data centre business and has actually delivered on commitments.

Anymore info about the Hiranandani venture? is Renesas really a JV partner or tech partner?