- Joined

- Jul 3, 2024

- Messages

- 790

- Likes

- 374

I mean yeah.

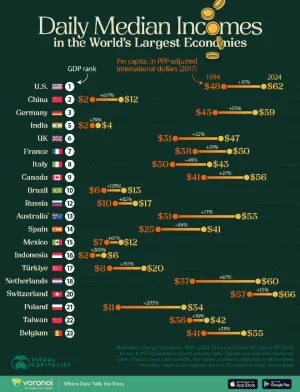

Gdp is based on exchange rates to dollar.

PPP is relatively more accurate measure of economic power, especially inside the country.

And actual economic might of country especially when you are looking militarly relies lot more on ppp than gdp.

Majority of the money in a military goes in salary, management, infra, pension, etc.

China can spend 3-4× less US spends per person in these cases

But it's complex too, for more high tech systems(tanks, fighters, missiles etc) the cost is similar internationally at most 20-30% difference( keep other things like scale of production etc as constant here).

The current chinese military budget at ~250billion( +~50 billion hidden budget) is equalivalent to 550-600 billion dollars in US budget.

This takes into account 3-4× reduction in cost of thing I mentioned + similar costs of high tech platform.

Another thing is 550-600 will be if US can use the money as efficiently as chinese, which it doesn't, so 700-800 is more realistic.

Same way india's 75billion dollars budget is equalivalento to ~250 billion dollars.

Russian 110 billion budget due to wartime, is equivalent to ~400-450 billion.

Russian peace time 60-70 billion budget is equalivent to 270-300 billion.

Surprisingly russia gets somewhat more bang for buck than India, that's the power of domestic industry and another main reason why imports are bad.

The concept of PPP is very good.

But it is very difficult to make statistics accurate

The final PPP calculation result is calculated by international organizations (such as the World Bank) or regional institutions based on the data submitted by various countries