Bhai koi explain karo... how would it be a loss for Hindenburg if he fails... & how much a loss it would be?

I just know buying and selling shares... zyada deep knowledge nahi hai.

Unlike Equity, the F&O ( future and options ) is the sector where these kind of parties bet in large amount.

Its kinda like betting, but for the general and ill informeds, who think market as a curve only.

In equity you can go long(cnc) and short for just intraday for now.

but for future or options you can bet in down side anticipating a fall for multiple days in advance.

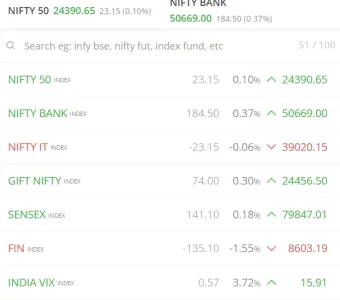

Every market reacts according to good or bad news either up or down way.

Hindenburg did that thing, they anticipated that after they spread the fear of compromised SEBI, the equity traders will close their long positions ( in simple- the bought shears) at current price, either at profit or at loss prematurely. That will lead a domino effect in Index or the Derivative section ( it mimic s the index movement).

BUT, unlike equity sector, FnO has one thing in negative-- the decay... and expiry.... the more days market goes against your anticipated, you keep losing the invested amount. In the day of contract expiry, the whole invested value goes to 0 or a small residual value.

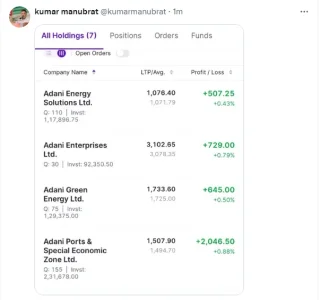

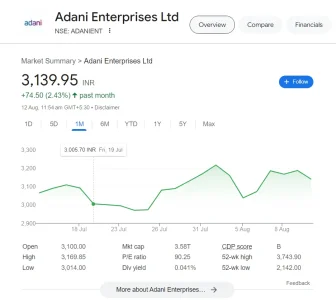

SO, if maket keeps on going up, the further market goes up, the more Hindenburg loses money... they have to either close the open contrats digesting the loss, or keep on losing.

And its has historically been observed that the down fall go multiple times faster that the up moves ( market can go down side the X amount in a single trading session which it had accumulated in may be months time frame)

So, what parties like hindenburg do is, bet for down side movement in Derivative section ( mostly Option Puts at far OTM premium, as it is way cheaper to buy than selling a call or future lot).

The further the market falls, the more the money invested gets multiplied.

Give or take 1 rupees of bought OTM put options goes around 800 rupees if market falls 1000 rupees ( that 80000% of invested money) in may be 1 hr or 30 min time frame, if market crashes.