You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese Economy Watch (7 Viewers)

- Thread starter rockdog

- Start date

More options

Who Replied?- Joined

- Jul 3, 2024

- Messages

- 792

- Likes

- 374

JinkoSolar-led group to build 10 GW solar cell, module factory in Saudi Arabia

A JinkoSolar-led consortium has announced plans to construct a 10 GW solar cell and module factory in Saudi Arabia with PIF and Vision Industries Company.July 16, 2024 Emiliano Bellini

Image: JinkoSolar

Chinese module maker JinkoSolar is leading a consortium that plans to build a 10 GW solar cell and module factory at an unspecified location in Saudi Arabia.

The company is operating through its local subsidiary, JinkoSolar Middle East DMCC, and partnering with Saudi-based consultancy Vision Industries (VI) and Renewable Energy Localization Company (RELC), a wholly-owned unit of Public Investment Fund (PIF), the sovereign wealth fund of Saudi Arabia.

“Pursuant to the Agreement, Jinko Middle East, RELC and VI agree to form a joint venture in Saudi Arabia with Jinko Middle East, RELC and VI holding 40%, 40% and 20% equity interest, respectively,” JinkoSolar said in a statement. “The formation of the joint venture is subject to customary preconditions, including obtaining the requisite regulatory approvals.”

The $1 billion project should be financed through internal funds and external financing. The company did not reveal more details about the plan.

Bin Omairah Holding currently operates a 1.2 GW solar module assembly factory in Saudi Arabia. The facility is located in the industrial district of Tabuk, northwestern Saudi Arabia. Spanish PV equipment supplier Mondragon Assembly provided the factory's production equipment.

- Joined

- Jul 3, 2024

- Messages

- 792

- Likes

- 374

- Joined

- Jul 3, 2024

- Messages

- 1,718

- Likes

- 2,292

Brussels move to end tax loophole exploited by China-linked marketplaces could also hit Shein’s planned London listingThe EU is moving forward with plans to impose customs duty on cheap goods in a shift that could hit imports from online retailers and harm a hoped-for London listing by the fast-fashion seller Shein.

The potential change comes amid growing disquiet among retailers based in mainland Europe, the UK and the US about rising competition from the Chinese-linked marketplaces Shein and Temu, which exploit a loophole that excludes low-value items from import duty.

In the EU, the threshold for the levy is €150 (£127) and in the UK it is £135, enabling retailers such as Shein to ship products directly from overseas to shoppers in those markets without paying any import duty. In the UK, items valued at £39 or less also do not attract import VAT.

Subsidised postage costs in China make it more cost-effective for businesses based there to send cheap goods by air.

A European Commission spokesperson said: “In May last year we put on the table customs reforms for a simple, smarter and safer customs union. What we have proposed now is there is no exemption any more for packages valued at below €150.”

The e-commerce proposal must first be discussed and accepted by the European parliament, which sits again later this month.

EU plan to impose import duty on cheap goods could dent Shein and Temu

Brussels move to end tax loophole exploited by China-linked marketplaces could also hit Shein’s planned London listing

Do not think later India will not do the same

E-commerce platforms Shein, Temu and AliExpress have been at the center of the debate for months, accused by various business chambers of unfair competition and of taking advantage of the import regulations established in the Treaty between Mexico, the United States and Canada (T-MEC) to obtain tax benefits. However, they could find in nearshoring an opportunity to strengthen their presence in Mexico and other markets in the region.

Shein even already has a plan in mind. The Asian company is considering establishing a network of clothing manufacturers in Mexico, in a scheme similar to the one it already implements in Brazil. However, in Mexico it faces the challenge of developing not only the manufacturing points, but also the logistics network for last-mile deliveries.

Marcelo Claure, president of Shein Latin America, declared last year that Mexico has the competitive advantage of having an advanced textile industry, although he did not specify the number of Mexican factories that could be integrated into its value chain, if the plan to set up in Mexico comes to fruition.

¿Cómo planea México regular a Shein, Temu y AliExpress sin violar el T-MEC?

Las compañías asiáticas deberán elegir entre relocalizar operaciones de manufactura y logística en México o enfrentar la exigencia de cumplir con las Normas Oficiales Mexicanas (NOM).

SAT goes against Temu and Shein for their business model and modifies the rules of foreign trade

SAT explains that the business model of companies such as Temu or Shein could incur the crime of smuggling and tax fraud.

The agency identified irregular maneuvers in the importation of various goods. It states that these mechanisms are designed to evade the payment of the general import tax (IGI) and the value added tax (VAT). "Imports of clothing, home decorations, jewelry, kitchen utensils, toys, electronics, among others, have increased, in which foreign companies dedicated to online sales, e-commerce platforms, consignees and courier and parcel companies participate." It explains that these companies could incur in the crime of smuggling and tax fraud by omitting tax charges and failing to comply with non-tariff regulations and restrictions.

El SAT va contra Temu y Shein por su modelo de negocio y modifica las reglas del comercio exterior

El SAT explica que el modelo de negocio de empresas como Temu o Shein podría incurrir en el delito de contrabando y defraudación fiscal.

Last edited:

- Joined

- Jul 3, 2024

- Messages

- 1,718

- Likes

- 2,292

Less Chinese workers means more Chinese unemployment, more oversupply means more tariffs, lower demand means lower prices, lower prices means lower profits and ultra Cheap prices by TEMU wow I can see it now a cell phone for US$ 0.30 cents

- Joined

- Jul 3, 2024

- Messages

- 792

- Likes

- 374

**The World's First Thorium Reactor Power Plant**

China plans to start construction of the world's first molten salt reactor power plant next year in the Gobi Desert.

The new thorium molten salt reactor does not require water for cooling as it uses molten salt and carbon dioxide to transfer heat and generate electricity. Using thorium as the key fuel, this design alleviates concerns about uranium shortages, a common fuel in nuclear reactors, since thorium is more abundant than uranium, Interesting Engineering reported on July 26.

According to estimates from some scientists, China has enough thorium reserves to meet its electricity needs for 20,000 years. The reactor is scheduled to be completed and operational by 2029, generating heat at a maximum capacity of 60 megawatts (MW). A portion of the thermal energy will power a 10 MW generator, while the remainder will produce hydrogen by splitting water molecules at high temperatures.

The modular small molten salt thorium reactor will be constructed and operated by the Shanghai Institute of Applied Physics, part of the Chinese Academy of Sciences. The institute shared the construction plan in an environmental assessment report. This project will "promote the development of various technologies including the production of high-end materials and equipment," said the Shanghai Nuclear Engineering Design and Research Institute. It will help China achieve energy independence.

Currently, the only operational thorium reactor on Earth is also located in the Gobi Desert, 120 km northwest of Wuwei city in Gansu province. This experimental reactor can only produce 2 MW of thermal energy and does not generate electricity. However, it integrates several revolutionary technologies, including superalloys that can withstand high temperatures, radiation, and chemical corrosion.

This small reactor was licensed to operate by the Chinese Nuclear Safety Administration in June last year and achieved a sustained nuclear chain reaction in October of the same year. The success of the pilot project provides a foundation and experience for constructing larger reactors capable of generating electricity. This is the first time China has disclosed the operational status of the experimental reactor.

Molten salt thorium nuclear reactors have several potential military applications due to their compact and safe structure, such as providing power for naval ships, submarines, and even aircraft. The site for the new generation reactor is located west of the small experimental reactor, occupying less space than a football field. The molten salt feeds thorium fuel into the reactor core through pipes to undergo a chain reaction. As the temperature rises, it flows out the other end and transfers heat to the remaining molten salt while thorium circulates through a separate loop. The non-radioactive molten salt then flows into a nearby power plant, powering a gas turbine based on carbon dioxide to generate electricity.

The new project also includes various facilities such as a research center and a spent fuel processing plant. According to reports, over 80% of the spent fuel will be recycled, while the remaining radioactive waste will be solidified into glass and transported to a deep geological repository in the Gobi Desert. Currently, most uranium-fueled reactors that use water for cooling pose an explosion risk if the pumps fail. However, in the thorium reactor, molten salt can flow into a containment chamber below the reactor, posing no threat to the surrounding environment.

The new reactor will be used for research purposes by scientists. However, a wind power facility, a solar power plant, a molten salt energy storage facility, a thermal power plant, and a chemical production facility will also be built simultaneously with the thorium power plant.

Various energy types will be integrated into a smart grid to provide sufficient, affordable, low-carbon, and stable electricity for industrial production. Starting in 2020, China will begin constructing commercial modular thorium reactors with a power generation capacity of 100 MW or more. Chinese shipbuilders are also introducing the world’s first design for massive container ships powered by molten salt reactors.

Some scientists remain skeptical about the feasibility of this technology. A major challenge that the reactor faces is that the metal pipes become brittle and can even crack under the effects of high temperatures, corrosion, and radiation from molten salt. Discovering new uranium deposits and increasing production also seem to make the transition to thorium fuel less urgent.

Currently, China is developing 6 to 8 nuclear reactors each year, using newly developed technology. In fact, Beijing's plan is that by 2035, the number of advanced reactors in China will reach 150, surpassing the total number of reactors in the U.S. and France combined.

---

China plans to start construction of the world's first molten salt reactor power plant next year in the Gobi Desert.

The new thorium molten salt reactor does not require water for cooling as it uses molten salt and carbon dioxide to transfer heat and generate electricity. Using thorium as the key fuel, this design alleviates concerns about uranium shortages, a common fuel in nuclear reactors, since thorium is more abundant than uranium, Interesting Engineering reported on July 26.

According to estimates from some scientists, China has enough thorium reserves to meet its electricity needs for 20,000 years. The reactor is scheduled to be completed and operational by 2029, generating heat at a maximum capacity of 60 megawatts (MW). A portion of the thermal energy will power a 10 MW generator, while the remainder will produce hydrogen by splitting water molecules at high temperatures.

The modular small molten salt thorium reactor will be constructed and operated by the Shanghai Institute of Applied Physics, part of the Chinese Academy of Sciences. The institute shared the construction plan in an environmental assessment report. This project will "promote the development of various technologies including the production of high-end materials and equipment," said the Shanghai Nuclear Engineering Design and Research Institute. It will help China achieve energy independence.

Currently, the only operational thorium reactor on Earth is also located in the Gobi Desert, 120 km northwest of Wuwei city in Gansu province. This experimental reactor can only produce 2 MW of thermal energy and does not generate electricity. However, it integrates several revolutionary technologies, including superalloys that can withstand high temperatures, radiation, and chemical corrosion.

This small reactor was licensed to operate by the Chinese Nuclear Safety Administration in June last year and achieved a sustained nuclear chain reaction in October of the same year. The success of the pilot project provides a foundation and experience for constructing larger reactors capable of generating electricity. This is the first time China has disclosed the operational status of the experimental reactor.

Molten salt thorium nuclear reactors have several potential military applications due to their compact and safe structure, such as providing power for naval ships, submarines, and even aircraft. The site for the new generation reactor is located west of the small experimental reactor, occupying less space than a football field. The molten salt feeds thorium fuel into the reactor core through pipes to undergo a chain reaction. As the temperature rises, it flows out the other end and transfers heat to the remaining molten salt while thorium circulates through a separate loop. The non-radioactive molten salt then flows into a nearby power plant, powering a gas turbine based on carbon dioxide to generate electricity.

The new project also includes various facilities such as a research center and a spent fuel processing plant. According to reports, over 80% of the spent fuel will be recycled, while the remaining radioactive waste will be solidified into glass and transported to a deep geological repository in the Gobi Desert. Currently, most uranium-fueled reactors that use water for cooling pose an explosion risk if the pumps fail. However, in the thorium reactor, molten salt can flow into a containment chamber below the reactor, posing no threat to the surrounding environment.

The new reactor will be used for research purposes by scientists. However, a wind power facility, a solar power plant, a molten salt energy storage facility, a thermal power plant, and a chemical production facility will also be built simultaneously with the thorium power plant.

Various energy types will be integrated into a smart grid to provide sufficient, affordable, low-carbon, and stable electricity for industrial production. Starting in 2020, China will begin constructing commercial modular thorium reactors with a power generation capacity of 100 MW or more. Chinese shipbuilders are also introducing the world’s first design for massive container ships powered by molten salt reactors.

Some scientists remain skeptical about the feasibility of this technology. A major challenge that the reactor faces is that the metal pipes become brittle and can even crack under the effects of high temperatures, corrosion, and radiation from molten salt. Discovering new uranium deposits and increasing production also seem to make the transition to thorium fuel less urgent.

Currently, China is developing 6 to 8 nuclear reactors each year, using newly developed technology. In fact, Beijing's plan is that by 2035, the number of advanced reactors in China will reach 150, surpassing the total number of reactors in the U.S. and France combined.

---

Lol**The World's First Thorium Reactor Power Plant**

China plans to start construction of the world's first molten salt reactor power plant next year in the Gobi Desert.

The new thorium molten salt reactor does not require water for cooling as it uses molten salt and carbon dioxide to transfer heat and generate electricity. Using thorium as the key fuel, this design alleviates concerns about uranium shortages, a common fuel in nuclear reactors, since thorium is more abundant than uranium, Interesting Engineering reported on July 26.

According to estimates from some scientists, China has enough thorium reserves to meet its electricity needs for 20,000 years. The reactor is scheduled to be completed and operational by 2029, generating heat at a maximum capacity of 60 megawatts (MW). A portion of the thermal energy will power a 10 MW generator, while the remainder will produce hydrogen by splitting water molecules at high temperatures.

The modular small molten salt thorium reactor will be constructed and operated by the Shanghai Institute of Applied Physics, part of the Chinese Academy of Sciences. The institute shared the construction plan in an environmental assessment report. This project will "promote the development of various technologies including the production of high-end materials and equipment," said the Shanghai Nuclear Engineering Design and Research Institute. It will help China achieve energy independence.

Currently, the only operational thorium reactor on Earth is also located in the Gobi Desert, 120 km northwest of Wuwei city in Gansu province. This experimental reactor can only produce 2 MW of thermal energy and does not generate electricity. However, it integrates several revolutionary technologies, including superalloys that can withstand high temperatures, radiation, and chemical corrosion.

This small reactor was licensed to operate by the Chinese Nuclear Safety Administration in June last year and achieved a sustained nuclear chain reaction in October of the same year. The success of the pilot project provides a foundation and experience for constructing larger reactors capable of generating electricity. This is the first time China has disclosed the operational status of the experimental reactor.

Molten salt thorium nuclear reactors have several potential military applications due to their compact and safe structure, such as providing power for naval ships, submarines, and even aircraft. The site for the new generation reactor is located west of the small experimental reactor, occupying less space than a football field. The molten salt feeds thorium fuel into the reactor core through pipes to undergo a chain reaction. As the temperature rises, it flows out the other end and transfers heat to the remaining molten salt while thorium circulates through a separate loop. The non-radioactive molten salt then flows into a nearby power plant, powering a gas turbine based on carbon dioxide to generate electricity.

The new project also includes various facilities such as a research center and a spent fuel processing plant. According to reports, over 80% of the spent fuel will be recycled, while the remaining radioactive waste will be solidified into glass and transported to a deep geological repository in the Gobi Desert. Currently, most uranium-fueled reactors that use water for cooling pose an explosion risk if the pumps fail. However, in the thorium reactor, molten salt can flow into a containment chamber below the reactor, posing no threat to the surrounding environment.

The new reactor will be used for research purposes by scientists. However, a wind power facility, a solar power plant, a molten salt energy storage facility, a thermal power plant, and a chemical production facility will also be built simultaneously with the thorium power plant.

Various energy types will be integrated into a smart grid to provide sufficient, affordable, low-carbon, and stable electricity for industrial production. Starting in 2020, China will begin constructing commercial modular thorium reactors with a power generation capacity of 100 MW or more. Chinese shipbuilders are also introducing the world’s first design for massive container ships powered by molten salt reactors.

Some scientists remain skeptical about the feasibility of this technology. A major challenge that the reactor faces is that the metal pipes become brittle and can even crack under the effects of high temperatures, corrosion, and radiation from molten salt. Discovering new uranium deposits and increasing production also seem to make the transition to thorium fuel less urgent.

Currently, China is developing 6 to 8 nuclear reactors each year, using newly developed technology. In fact, Beijing's plan is that by 2035, the number of advanced reactors in China will reach 150, surpassing the total number of reactors in the U.S. and France combined.

---

India has been building thorium reactors for decades

- Joined

- Jul 3, 2024

- Messages

- 792

- Likes

- 374

China outspends the US on fusion in the race for energy’s holy grail

China wants to dominate commercial fusion, a long-dreamed-of clean energy source that is attracting new investment.

Jennifer Hiller, Sha Hua (with inputs from The Wall Street Journal)A high-tech race is under way between the U.S. and China as both countries chase an elusive energy source: fusion.

China is outspending the U.S., completing a massive fusion technology campus and launching a national fusion consortium that includes some of its largest industrial companies.

Crews in China work in three shifts, essentially around the clock, to complete fusion projects. And the Asian superpower has 10 times as many Ph.D.s in fusion science and engineering as the U.S.

The result is an increasing worry among American officials and scientists that an early U.S. lead is slipping away.

JP Allain, who heads the Department of Energy’s Office of Fusion Energy Sciences, said China is spending around $1.5 billion a year on fusion, nearly twice the U.S. government’s fusion budget. What’s more, China appears to be following a program similar to the road map that hundreds of U.S. fusion scientists and engineers first published in 2020 in hopes of making commercial fusion energy.

“They’re building our long-range plan,” Allain said. “That’s very frustrating, as you can imagine.”

Scientists familiar with China’s fusion facilities said that if it continues its current pace of spending and development, it will surpass the U.S. and Europe’s magnetic fusion capabilities in three or four years.

Fusion has long been a clean-energy dream. The process of combining atoms is the same process that powers the sun, and scientists hope to harness it to deliver almost-limitless energy. The technology faces daunting science and engineering hurdles, and some experts consider it a mirage that will remain out of reach.

Though a scientific breakthrough on fusion could benefit all of humanity, some in the U.S. fear it would give China a leg up in a growing competition over energy resources as the U.S. and others try to shift more production and supply chains within domestic borders.

China already has a fast-growing nuclear-technology industry and is building more conventional nuclear power plants than any other country. The country’s nuclear-plant development will give it an advantage when commercial fusion is reached, according to a report released last month by the Information Technology and Innovation Foundation, a Washington, D.C.-based think tank with backers that include big tech companies.

Nuclear fusion occurs when two light atomic nuclei merge to form a single heavier one. That process releases huge amounts of energy, no carbon emissions and limited radioactivity—if someone can get it to work.

Scientists around the world are trying to figure out how to sustain fusion reactions and engineer a way to turn that energy into net power. The U.S. leads on a technology that uses lasers to create fusion reactions, though magnetic fusion—using magnetic fields to confine plasma—is where many experts expect commercialization first.

China’s fusion push

China is putting vast resources into chasing the abundant-energy dream. Crews in China break only around Lunar New Year, according to scientists familiar with the efforts.“They’re going to put a lot of human capital and a lot of money and a lot of organization around it. And the question will be, can they figure out the technology?” said Bob Mumgaard, chief executive of Commonwealth Fusion Systems, the largest private fusion company in the U.S., with investors that include Bill Gates.

The Chinese Academy of Sciences’ Institute of Plasma Physics in the eastern Chinese city of Hefei in 2018 broke ground on a nearly 100-acre magnetic fusion research and technology campus. The facility is expected to be completed next year but is already largely operational and focused on industrializing the technology.

Late last year, China said it would form a new national fusion company, and said the state-owned Chinese National Nuclear Corp. would lead a consortium of state-owned industrial firms and universities pursuing fusion energy. Among the largest efforts by a private Chinese company are those of ENN, an energy conglomerate, which created a fusion division from scratch in 2018.

Since then, ENN has built two tokamaks, the machines where fusion can happen, using powerful magnets to hold plasma. ENN’s fusion work isn’t well-understood outside of China and its pace of development would be difficult to replicate in the U.S. or Europe.

Fusion has seen a burst of interest from governments and private investors since August 2021. Investments in fusion technology surged in 2022 after scientists at Lawrence Livermore National Laboratory in California achieved “ignition”—a fusion reaction that produced more energy than it consumed. The federal research lab has achieved the key milestone four times since.

The Biden administration in 2022 set a goal of achieving commercial fusion energy within a decade and requested $1 billion for fusion in its recent budget proposal. Organizing a U.S. public-private fusion consortium, similar to a 1980s and ’90s semiconductor program, was a suggestion discussed at a recent White House event. Some recent DOE awards were structured similarly to the way NASA has boosted the commercial space industry.

Tammy Ma, lead for the Inertial Fusion Energy Initiative at Lawrence Livermore’s National Ignition Facility, said the U.S. fusion budget of $790 million for the 2024 fiscal year, a 4% increase from the year prior, hasn’t been enough to keep pace with inflation. The sluggish growth has meant fewer research grants and grant-funded positions available in U.S. graduate schools, Ma said.

Not clear who will win

The fusion world is full of frenemies who believe their technology and approach is the best to meet the world’s energy needs. Most are collegial competitors with partnerships that spiderweb the globe. But cooperation has been complicated by the increasingly adversarial relationship between China and the West, especially the U.S.China for decades has invested in raw materials and technologies that are key to the low-carbon transition. Many of those are also used by fusion firms and researchers, including powerful magnets to hold plasmas in place and lithium, which can be used as a blanket layer around a fusion reactor to absorb neutrons produced in plasmas, among other technologies.

Fusion scientists have swapped and shared information since the late 1950s, when countries began declassifying fusion energy research. China, Russia and the U.S. are among the 35 countries involved in the International Thermonuclear Experimental Reactor, or ITER, in France.

Chinese scientists participate in international fusion conferences and seem most comfortable sharing information through direct conversations, other scientists say, though language is an obstacle.

U.S. Rep. Don Beyer, a Virginia Democrat and co-chair of Congress’s Fusion Energy Caucus, said that much U.S. fusion spending goes to legacy programs, “not the cutting-edge stuff.”

“In China, from what we can tell, most of their billion and a half is actually going to build stuff that would compete with Helion or Commonwealth Fusion,” Beyer said, referring to two of the largest private fusion firms in the U.S.

For decades, China had “almost nothing” of a fusion program, said Dennis Whyte, a professor of engineering at MIT, who for several years sat on Chinese fusion advisory committees. It took China about 10 years to build a world-class fusion science program and national labs.

“It was almost like a flash that they were able to get there,” Whyte said. “Don’t underestimate their capabilities about coming up to speed.”

The U.S. has advantages with an entrepreneurial approach but needs better coordination between private companies, universities and the government, similar to what was used in the 1950s to develop the nuclear submarine program, Whyte said.

“It’s not clear to me who will win,” he said.

- Joined

- Jun 30, 2024

- Messages

- 3,568

- Likes

- 30,726

They aren't Thorium reactors

- Joined

- Jul 3, 2024

- Messages

- 792

- Likes

- 374

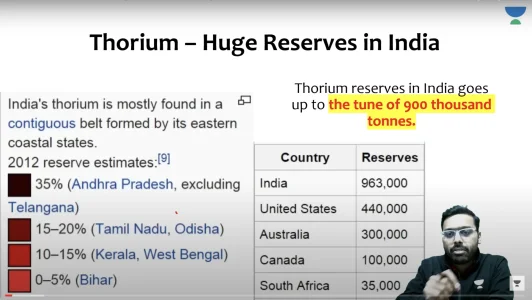

View attachment 4591

India has 9x the thorium reserves as China.

China's reserves of thorium resources are about 300,000 tons

- Joined

- Jun 27, 2024

- Messages

- 962

- Likes

- 6,880

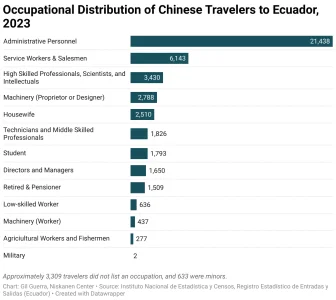

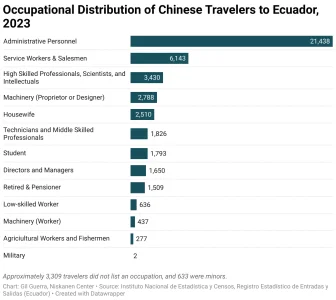

Some interesting data on people fleeing China. Unlike many other countries, these are not your truck drivers or blue collar workers. A lot of them seem to have tertiary degrees, engineers, scientists or researchers. Additionally, Ecuador also suspended visa free travel for Chinese citizens.

Source: https://www.niskanencenter.org/a-data-guide-to-chinese-migrants-at-the-border/

Source: https://www.niskanencenter.org/a-data-guide-to-chinese-migrants-at-the-border/

- Joined

- Jul 3, 2024

- Messages

- 792

- Likes

- 374

Egypt-Saudi-China venture wins EPC contract for Port of NEOM

Mobile Crane on a road and tower crane in construction site. Getty Images Image used for illustrative purpose.

Getty Images

The contract is for development of container terminal 1 and marine services area

Staff Writer, Zawya Projects

July 29, 2024

RELATED TOPICS

EGYPTSAUDI ARABIACHINA (PRC)INFRASTRUCTURECONSTRUCTION

A partnership between the Saudi unit of Egypt’s Hassan Allam Construction Saudi, Riyadh-based El Seif Engineering Contracting and China Harbour Engineering Arabia has won a construction contract for the Port of NEOM in Oxagon.

The project scope includes an engineering, procurement and construction (EPC) contract for developing Port of NEOM’s container terminal 1 and the marine services area (MSA), Hassan Allam Holding said in a statement on Sunday.

The contract includes the design and construction of MSA and T1 buildings, as well as the infrastructure and entrance zone to the new terminal, which is set to open in 2025.

No financial details were disclosed.

The Port of NEOM will provide container, general cargo, bulk, and roll-on/roll-off ferry services.

Additionally, the port’s strategic location provides global and regional connectivity to support the Kingdom’s maritime and economic ambitions in line with Vision 2030.

China outspends the US on fusion in the race for energy’s holy grail

China wants to dominate commercial fusion, a long-dreamed-of clean energy source that is attracting new investment.

Jennifer Hiller, Sha Hua (with inputs from The Wall Street Journal)

A high-tech race is under way between the U.S. and China as both countries chase an elusive energy source: fusion.

China is outspending the U.S., completing a massive fusion technology campus and launching a national fusion consortium that includes some of its largest industrial companies.

Crews in China work in three shifts, essentially around the clock, to complete fusion projects. And the Asian superpower has 10 times as many Ph.D.s in fusion science and engineering as the U.S.

The result is an increasing worry among American officials and scientists that an early U.S. lead is slipping away.

JP Allain, who heads the Department of Energy’s Office of Fusion Energy Sciences, said China is spending around $1.5 billion a year on fusion, nearly twice the U.S. government’s fusion budget. What’s more, China appears to be following a program similar to the road map that hundreds of U.S. fusion scientists and engineers first published in 2020 in hopes of making commercial fusion energy.

“They’re building our long-range plan,” Allain said. “That’s very frustrating, as you can imagine.”

Scientists familiar with China’s fusion facilities said that if it continues its current pace of spending and development, it will surpass the U.S. and Europe’s magnetic fusion capabilities in three or four years.

Fusion has long been a clean-energy dream. The process of combining atoms is the same process that powers the sun, and scientists hope to harness it to deliver almost-limitless energy. The technology faces daunting science and engineering hurdles, and some experts consider it a mirage that will remain out of reach.

Though a scientific breakthrough on fusion could benefit all of humanity, some in the U.S. fear it would give China a leg up in a growing competition over energy resources as the U.S. and others try to shift more production and supply chains within domestic borders.

China already has a fast-growing nuclear-technology industry and is building more conventional nuclear power plants than any other country. The country’s nuclear-plant development will give it an advantage when commercial fusion is reached, according to a report released last month by the Information Technology and Innovation Foundation, a Washington, D.C.-based think tank with backers that include big tech companies.

Nuclear fusion occurs when two light atomic nuclei merge to form a single heavier one. That process releases huge amounts of energy, no carbon emissions and limited radioactivity—if someone can get it to work.

Scientists around the world are trying to figure out how to sustain fusion reactions and engineer a way to turn that energy into net power. The U.S. leads on a technology that uses lasers to create fusion reactions, though magnetic fusion—using magnetic fields to confine plasma—is where many experts expect commercialization first.

China’s fusion push

China is putting vast resources into chasing the abundant-energy dream. Crews in China break only around Lunar New Year, according to scientists familiar with the efforts.

“They’re going to put a lot of human capital and a lot of money and a lot of organization around it. And the question will be, can they figure out the technology?” said Bob Mumgaard, chief executive of Commonwealth Fusion Systems, the largest private fusion company in the U.S., with investors that include Bill Gates.

The Chinese Academy of Sciences’ Institute of Plasma Physics in the eastern Chinese city of Hefei in 2018 broke ground on a nearly 100-acre magnetic fusion research and technology campus. The facility is expected to be completed next year but is already largely operational and focused on industrializing the technology.

Late last year, China said it would form a new national fusion company, and said the state-owned Chinese National Nuclear Corp. would lead a consortium of state-owned industrial firms and universities pursuing fusion energy. Among the largest efforts by a private Chinese company are those of ENN, an energy conglomerate, which created a fusion division from scratch in 2018.

Since then, ENN has built two tokamaks, the machines where fusion can happen, using powerful magnets to hold plasma. ENN’s fusion work isn’t well-understood outside of China and its pace of development would be difficult to replicate in the U.S. or Europe.

Fusion has seen a burst of interest from governments and private investors since August 2021. Investments in fusion technology surged in 2022 after scientists at Lawrence Livermore National Laboratory in California achieved “ignition”—a fusion reaction that produced more energy than it consumed. The federal research lab has achieved the key milestone four times since.

The Biden administration in 2022 set a goal of achieving commercial fusion energy within a decade and requested $1 billion for fusion in its recent budget proposal. Organizing a U.S. public-private fusion consortium, similar to a 1980s and ’90s semiconductor program, was a suggestion discussed at a recent White House event. Some recent DOE awards were structured similarly to the way NASA has boosted the commercial space industry.

Tammy Ma, lead for the Inertial Fusion Energy Initiative at Lawrence Livermore’s National Ignition Facility, said the U.S. fusion budget of $790 million for the 2024 fiscal year, a 4% increase from the year prior, hasn’t been enough to keep pace with inflation. The sluggish growth has meant fewer research grants and grant-funded positions available in U.S. graduate schools, Ma said.

Not clear who will win

The fusion world is full of frenemies who believe their technology and approach is the best to meet the world’s energy needs. Most are collegial competitors with partnerships that spiderweb the globe. But cooperation has been complicated by the increasingly adversarial relationship between China and the West, especially the U.S.

China for decades has invested in raw materials and technologies that are key to the low-carbon transition. Many of those are also used by fusion firms and researchers, including powerful magnets to hold plasmas in place and lithium, which can be used as a blanket layer around a fusion reactor to absorb neutrons produced in plasmas, among other technologies.

Fusion scientists have swapped and shared information since the late 1950s, when countries began declassifying fusion energy research. China, Russia and the U.S. are among the 35 countries involved in the International Thermonuclear Experimental Reactor, or ITER, in France.

Chinese scientists participate in international fusion conferences and seem most comfortable sharing information through direct conversations, other scientists say, though language is an obstacle.

U.S. Rep. Don Beyer, a Virginia Democrat and co-chair of Congress’s Fusion Energy Caucus, said that much U.S. fusion spending goes to legacy programs, “not the cutting-edge stuff.”

“In China, from what we can tell, most of their billion and a half is actually going to build stuff that would compete with Helion or Commonwealth Fusion,” Beyer said, referring to two of the largest private fusion firms in the U.S.

For decades, China had “almost nothing” of a fusion program, said Dennis Whyte, a professor of engineering at MIT, who for several years sat on Chinese fusion advisory committees. It took China about 10 years to build a world-class fusion science program and national labs.

“It was almost like a flash that they were able to get there,” Whyte said. “Don’t underestimate their capabilities about coming up to speed.”

The U.S. has advantages with an entrepreneurial approach but needs better coordination between private companies, universities and the government, similar to what was used in the 1950s to develop the nuclear submarine program, Whyte said.

“It’s not clear to me who will win,” he said.

View: https://youtu.be/ig2ghowz3xY?si=oMgN2XUoKyz96s5a

Users who are viewing this thread

Total: 6 (members: 0, guests: 6)

Latest Replies

-

Operation Sindoor & Aftermath

- crazywithmath

-

DRDO & PSUs

- fire starter

-

Indian Army: News and Updates

- Meghnath_03

-

Indian Economy

- eastern_bhartiya

-

Jokes Thread

- Unknowncommando

-

UPA Policies & Scams- 2004 to 2014

- swesh Annonamys Sanatani

-

Indian Navy Developments & Discussions

- vampyrbladez

-

Indian Small Arms & Weapons

- Delta Squad