What We Know About Ukraine’s Army Of Robot Dogs

David Hambling

Senior Contributor

I'm a South London-based technology journalist, consultant and author

Follow

0

Aug 16, 2024,05:27am EDT

Updated Aug 17, 2024, 08:40am EDT

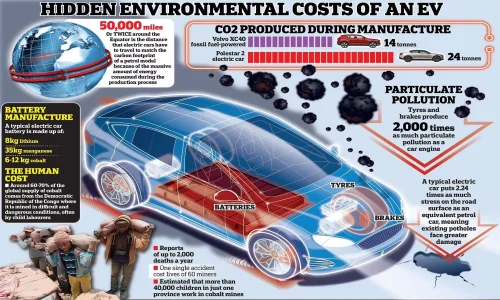

Operator Kurt of the 28th Brigade with one of the units quaduped robots

28th Brigade

Ukraine is now using robotic dogs on the battlefield, the first known combat deployment of such machines. The robots were supplied by a British company and are not autonomous; they are operated by remote control, a walking version of the ubiquitous aerial drones.

“Every unit should have one of these dogs,” says Kurt, a commander in the 28th Mechanized Brigade, in an

X/Twitter post on the official Ministry of Defence account.

Robots In Disguise

According to a piece in

German tabloid newspaper Bild, misleadingly headlined “Robot dogs sniff out Russian soldiers” a British company, Robot Alliance, has supplied 30 of the dogs. The Bild piece states that the robots explore inside buildings, trenches and dense woodland where drones cannot go. They are used to locate booby traps and to locate Russian forces, but do not actually have sniffing sensors.

Bild states the robots can run at up to 9 mph with a battery life of up to five hours and can be controlled from up to two miles away. They quote a price of 4,000-8,000 Euros ($4400-$8,800) depending on the version. Video of Ukrainian operations in the Donetsk region shows the robot dog covered by a camouflage blanket made by German suppliers

Concamo which makes it difficult to detect both visually and with thermal imaging. As soon as the robot stops moving it merges into the background vegetation.

A press release on the robots from Ukrainian

fundraising platform United24 notes that data held on the robot can be erased instantly if it is captured to remove the chance of the enemy gaining any information from it.

Forbes Daily: Join over 1 million Forbes Daily subscribers and get our best stories, exclusive reporting and essential analysis of the day’s news in your inbox every weekday.

Get the latest news on special offers, product updates and content suggestions from Forbes and its affiliates.

Sign Up

By signing up, you agree to our

Terms of Service, and you acknowledge our

Privacy Statement. Forbes is protected by reCAPTCHA, and the Google

Privacy Policy and

Terms of Service apply.

MORE FOR YOU

A Notorious Marine Battalion Has Joined Ukraine’s Invasion Of Russia

‘Inside Out 2’ Debuts On Digital Streaming This Week

Acclaimed Horror Thriller Oddity Debuts On Digital Streaming This Week

Used In Ukraine, Made in China

The supplier named by Bild,

Brit Alliance, is a security company based in the UK. They provide a wide range of services including from protection individual VIPs to safeguarding international shipping. They also help with military training and drone security and surveillance. The company did not respond to a request for information but their company site indicates they are active in Ukraine.

00:02

02:24

Read More

“We already have a wealth of experience in this rapidly developing area, deploying drones in Ukraine and across the globe,”

states the Brit Alliance website.

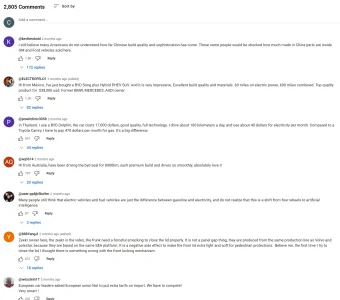

The robot dogs are currently used for scouting in difficult locations

28th Brigade

Brit Alliance is a security firm, not a robot manufacturer, and clearly did not make the machines themselves. It did not take internet analysts long to identify the robots in Ukraine as being Chinse-made Unitree Go2 Pros, which might be seen as the legged equivalent of Chinese-made DJI quadcopters: efficient, high-spec machines easily available at low cost.

The

UniTree Go2 Pro costs $3,500 plus $1,000 shipping from China without extras and is stated as having an 11 mph top speed, in line with the Bild report. Weighing under 30 pounds, the Go2 is conveniently portable with the legs folding up for easy carrying,

The Go2 Pro has an intelligent control system with multiple sets of fisheye cameras looking in all directions, plus a powerful 1.5 TFlop processor and smart software which enables it to remain stable even on uneven surfaces or rough ground. It is capable of a degree of autonomous operation such as following the operator visually, and can also do a smarter ‘side follow.’

A robot dog looks like a great toy, and many are sold as such, but what does it have to offer the military?

When Legs Beat Rotors

As a scout, the robot dog has two advantages over smaller, faster aerial drones.

Firstly, it can go places where they might have difficulty. While there are some specialist drones with shrouded rotors which can operate inside buildings, these are rare and even then flying is difficult. The robot dogs can easily explore indoor environments and search houses and bunkers, or walk through a trench system ahead of foot soldiers.

Secondly, while a drone will fly over tripwires, pressure plates and other booby traps, the robot dog will set them off. Troops know they can follow safely in the dog’s path. If it does trigger a mine or booby trap, repair or replacement is cheap and easy. It will always be preferable to put a robot in harms’ way rather than a human.

Interestingly though, operators get very attached to their machines: In Iraq, bomb disposal teams working with the much less appealing iRobot tracked robot insisted that their faithful machine be repaired and returned to them rather than replaced with a different one. One report suggested that

operators were getting “dangerously attached” to their robots and treated them like pets.

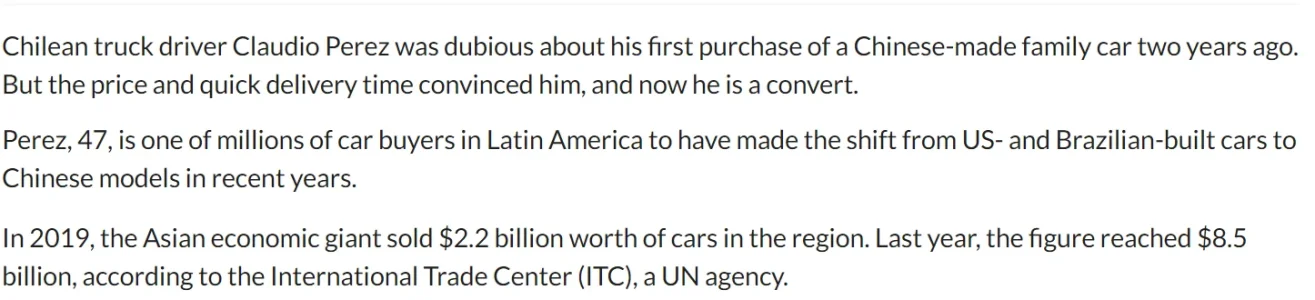

Ukrainian robot dog with unknown payload

28th Brigade

The quadruped has some other useful capabilities that put it ahead of small drones. One is its carrying capacity. Unitree says it can carry a payload of up to 9 pounds, and one image from Ukraine shows the machine carrying an unknown payload. This might be a sensor, a demolition charge, or simply a package of supplies. Ukraine has a variety of small wheeled and tracked robots which have been used to carry all of these things, and a legged robot can reach places inaccessible to other machines.

The Go2 Pro can also be

fitted with a robotic arm. These are not seen on any of the images from Ukraine, but would obviously be useful for opening doors, bomb disposal and other tasks.

Another feature is the battery life. The robot can go to a location and lie in wait for an extended period. This might be simply to monitor enemy movements, but later robots might play an active role in ambushes.

Robotic Warhounds

BigDog robot at Boston Dynamics, developed to help soldiers carry heavy equipment in the field

Boston Globe via Getty Images

The current generation of quadruped robots can be directly traced back to military research and development, in particular the BigDog developed for the U.S. Army by Boston Dynamics which

I wrote about way back in 2006. BigDog was envisaged as a robotic pack mule with impressive stability over difficult terrain, but noise and other factors prevented it from going further. Boston Dynamics later developed the small, cheaper and smarter

Spot robot dog which is now used in industry, and have moved away from the defence sector, stating that they do not support the military use of their products.

However, the ‘uncanny valley’ effect which makes

people see robot dogs as sinister and creepy – the famous

Black Mirror episode Metalhead was inspired by a Boston Dynamics video — means that Spot gets a

lot of unjustified abuse.

Meanwhile there are actual military quadrupeds. Ghost Robots

machin

es patrol U.S. Air Force bases in a trial project, essentially using the robot as a mobile CCTV camera. Others are more gung-ho; in 2021 Ghost Robotics displayed a version

armed with a remotely-operated sniper rifle, and last year the U.S. Marine Corps carried out an exercise with the same robot

firing an M72 anti-tank rocket launcher.

Ghost Robotics quadruped with sniper rifle

Ghost Robotics

However, while nobody much objects to

remotely-operated weapons turrets or armed drones, legged robots draw a much stronger response – sample headline “

Gun-toting robo-dogs look like a dystopian nightmare.” This may be why the U.S. military has not yet moved to deploy such machines – and even the NYPDs use of

unarmed robot dogs is highly controversial.

Others may be less concerned by public opinion. In China the PLA has released a

number of videos of its troops

training with armed quadruped robots, some of which look a lot like the Go2 Pro.

A Russian company also displayed a “Russian-made M-81 quadruped robot” armed with a rocket launcher in at the ARMY-2022 show. This was

soon unmasked as a rebranded Chinese Unitree, with the price hiked up to over $16,000, or about four times the actual cost.

For the present, the Ukrainians are just using their robot dogs for scouting and reconnaissance purposes, which is exactly how consumer quadcopters were first used before someone realized they could be used for attack missions. Ukraine has a policy of getting humans out of the front line and replacing them with technology wherever possible. They are already using remote-controlled machineguns with video camera,

known as Death Scythes; putting one on a quadruped robot might be a literal step forward. And it would certainly terrify the Russians.

thelogisticsworld.com

thelogisticsworld.com