- Joined

- Jul 3, 2024

- Messages

- 1,598

- Likes

- 2,204

BYD's Mexican plant produces cars for sale only in Mexico,

with no plans to sell them in the United States.

View: https://www.youtube.com/watch?v=fjBuUrmRnwI

BYD's Mexican plant produces cars for sale only in Mexico,

with no plans to sell them in the United States.

The ten companies that sold the most cars — manufactured in Mexico and imported, between January and July 2024 —, according to information collected by Inegi, are the following:

COMPANY UNITS

Nissan 142,722

General Motors 116,838

Volkswagen 74,990

Toyota 69,147

KIA 59,828

Mazda 52,768

Stellantis 52,063

Ford 30,403

Hyundai 29,384

MG Motor 29,152

As for models, these are the most popular, according to figures collected between January and August 2024:

Nissan Versa: 60,389

Chevrolet Aveo: 36,310

KIA K3: 27,154

Nissan March: 18,827

Volkswagen Virtus: 18,779

MG5: 17,505

Nissan Sentra: 14,599

Chevrolet Onix: 13,415

Mazda 3: 13,082

Volkswagen Jetta: 12,151

Regarding trucks, pick-ups, SUVs and minivans:

Nissan NP300: 37,617

Toyota Hilux: 15,273

Nissan Kicks: 15,159

Mazda CX30: 14,765

WV Taos: 12,110

KIA Seltos: 11,676

Captiva SUV: 11,259

Hyundai Creta: 10,970

GM Tornado van: 10,994

GM S10: 10,295

The data shows that SUV vehicles have accounted for almost 40% of sales, while light trucks (pick-ups) reached record sales last June. In addition, the automotive industry in Mexico continues to show growth despite external challenges and political uncertainty. With record production and sales figures, this sector is consolidating itself as one of the most important for the national economy.

Los autos más vendidos en México en lo que va de 2024

Las camionetas pequeñas, llamadas SUV, están conquistando cada vez más mercadoelpais.com

there are not official BYD data, but is highly unlikely they are selling EVs, if they sell cars very likly are not electric and their prices are very high.

Versión Precio

Sense TM '24 $ 311,900

Sense CVT '24 $ 314,900

Advance MT '24 $ 349,900

Advance CVT '24 $ 356,900

Nissan Versa 2025 - Precios especiales | Nissan México

Obtén el mejor precio de Nissan Versa 2024. ¡Aprovecha nuestros precios especiales y lleva a casa tu auto ideal hoy mismo!www.nissan.com.mx

BYD Mexico. Autos Liverpool. BYD Dolphin EV: Promotional price from $536,990 to only $485,900. BYD Yuan Plus EV: Promotional price from $799,000 to only $649,000.

cnevpost.com

cnevpost.com

expect is not a fact plus there are no offical sources at this moment how many cars are selling, but by the prices of their cars they are far far more expensive than Nissan.

BYD expects to sell 100,000 EVs in Mexico in 2025

BYD expects to sell 50,000 EVs in Mexico this year and 100,000 in 2025, the head of the company's Mexican operations said.cnevpost.com

BYD expects to sell 100,000 EVs in Mexico in 2025

BYD expects to sell 50,000 EVs in Mexico this year and 100,000 in 2025, the head of the company's Mexican operations said.cnevpost.com

BYD's Mexican plant produces cars for sale only in Mexico,

with no plans to sell them in the United States.

About 20 Democrats in the U.S. Congress on Tuesday urged President-elect Claudia Sheinbaum to address national security concerns raised by internet-connected vehicles produced by Chinese automakers in Mexico.

All modern cars and trucks have built-in networking hardware that provides internet access and allows them to share data with devices both inside and outside the vehicle.

The lawmakers led by Rep. Elissa Slotkin and Sen. Sherrod Brown called in a letter to Sheinbaum to set up a national review and send a delegation to the United States in early 2025 for talks.

The United States fears that China, a strategic and economic rival as well as a trading partner, could use data collected by connected vehicles for surveillance or, in extreme circumstances, control them remotely via the internet and navigation systems.

“We believe that this data set, under the control of the Chinese Communist Party, constitutes a threat to national security,” the letter, also signed by Senators Gary Peters, Debbie Stabenow and Tammy Baldwin, states.

Last week, US President Joe Biden proposed banning Chinese software and hardware in connected vehicles on US roads, which would effectively prevent Chinese cars and trucks from entering the US market and ban new vehicles produced in Mexico by Chinese automakers.

You may be interested in: Gustavo Petro claims that Claudia Sheinbaum collaborated with Colombian M-19 guerrillas

Biden increased tariffs on electric vehicles made in China by 100%

China rejects US criticism and has said that the country's measure “lacks a factual basis, violates the principles of market economy and fair competition and is a typical protectionist approach.”

The Biden administration is taking steps to prevent Chinese cars from being sold in the United States, and advocacy groups have warned of what they say is unfair competition from heavily state-subsidized Chinese electric vehicles.

This month, Biden raised tariffs on Chinese-made electric vehicles by 100%, even though only four Chinese light-duty vehicles are currently sold in the United States. Congress passed a law in 2022 to ban Chinese-made electric vehicles from receiving tax credits.

The lawmakers noted that Chinese automakers have made inroads into the Mexican market and said it raised “significant concerns” that they were now trying to use Mexico as a base to enter the U.S. market.

The letter noted that Chinese electric vehicle maker BYD plans to build a factory in Mexico, which it said “raises the possibility that Chinese companies will try to circumvent these U.S. tariffs with production in Mexico.”

With information from Reuters.

Legisladores estadounidenses piden a Sheinbaum abordar preocupaciones sobre vehículos chinos

EU teme que China pueda utilizar datos recopilados por vehículos conectados para vigilancia o, en circunstancias extremas, controlarlos.forbes.com.mx

BYD expects to sell 100,000 EVs in Mexico in 2025

BYD expects to sell 50,000 EVs in Mexico this year and 100,000 in 2025, the head of the company's Mexican operations said.cnevpost.com

correct but in Politics there is a term call Geopolitics.And they also need to be reminded that US is also doing the same by building backdoors in every US designed software and hardware devices. US is doing this way more than China could ever hope to dream.

correct but in Politics there is a term call Geopolitics.

Brazil is far far from China same South Africa, so geopolitically India is with the USA, you will ask why? the Chinese have border with India, Mexico has border with the USA, true we had war in th 19th century, but nowadays there are close to

India is a more likely an USA ally and Mexico has close to 20% of its population in the USA so we are also allies of the USA.

reality wise India should align with Russia or economically with the USA, it is geopolitics

agree, but the USA has no territorial dispute with India, but any way let us leave it hereOnly at America's pleasure. The problem is that America doesn't know what is the limit. They will keep pushing until you break and they move onto the next target. Its state department is insidious.

Please also list the amount of subsidies ALL these countries provide their shipbuilding yards especially China & save us the bother .

Western style of Making money

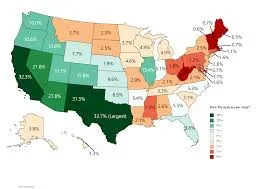

The investment picture is less clear. North American nearshoring/reshoring is on the rise as measured by the 2022 Kearney Nearshoring Index, which found a 78 percent increase from 2021 to 2022 in the number of CEOs evaluating reshoring their operations, moving to reshore, or having already reshored production. The Kearney index found that geopolitical risk was the leading factor in the surveyed CEO’s reshoring decisions. And shifting US supply chains away from China to friendly countries has been broadly popular, with 7 in 10 respondents to a 2022 survey by the Chicago Council on Global Affairs supporting “friendshoring.” This has translated to bipartisan support for the concept.