- Joined

- Jun 30, 2024

- Messages

- 3,625

- Likes

- 31,135

India’s Industrial Landscape in FY 2023-24: A Zone-wise Analysis – Part 1 of 4

Good

media.biltrax.com

media.biltrax.com

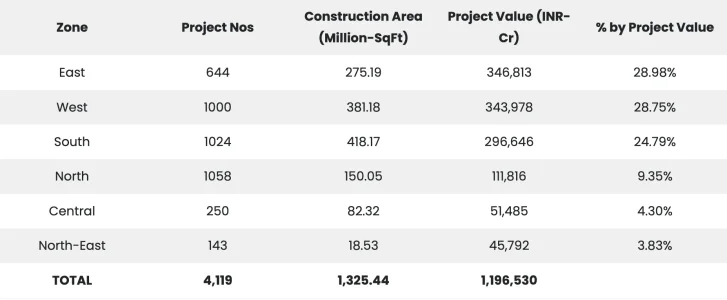

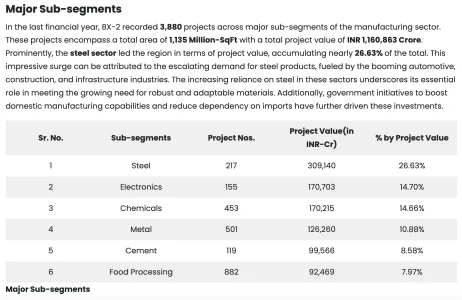

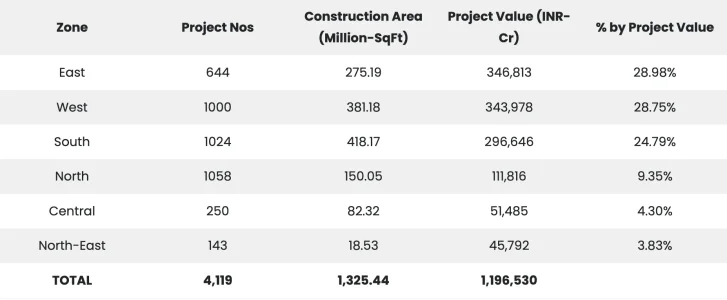

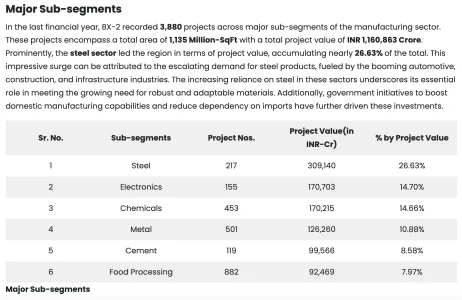

Biltrax plays a pivotal role in tracking and analyzing construction projects across India. As of June 2024, Biltrax monitors 50,507 live construction projects. These encompass more than 16.80 Billion-SqFt of construction area and a total estimated construction value of INR 9,580,862 Crore (USD 1.13 trillion). During FY 2023-24, the BX-2 platform documented 4,119 industrial projects (manufacturing+warehousing), covering 1.32 Billion-SqFt & INR 1,196,530 Crore of project value. Our zonal analysis for the last financial year highlights diverse construction activities across India’s six zones. The East Zone leads with the highest project value (346,813 INR-Crore) encompassing a total construction area of 275.19 Million-SqFt. This accounts for over one-third of India’s total construction project value. The West Zone follows closely, with projects covering 381.18 Million-SqFt of construction area and a project value of INR 343,978 Crore.

Good

India’s Industrial sector Landscape in FY 2023-24

This report provides a regional overview of India's industrial sector for FY 2023-24, focusing on the manufacturing and warehousing sectors.

media.biltrax.com

media.biltrax.com