- Joined

- Jul 1, 2024

- Messages

- 527

- Likes

- 5,102

@concard @crazywithmath et al

what is the domestic equivalent of FDI?

as in, is there a single source of such data for domestically funded investment, or does it have to be collated from multiple sources?

i remember going thru this in the old forum, now i can't recall the source data.

could be from corporate banking portfolio of major banks, but not sure.

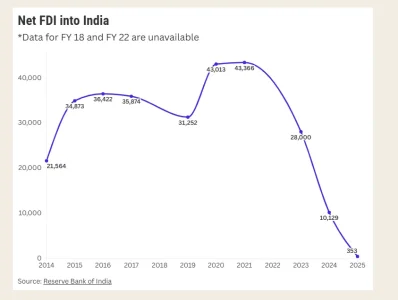

80 billion $ FDI is about 6.6 lakh crore.

domestically sourced investment will definitely be multiple times of fdi value per year, i am assuming.

Loans given to MSME and Indian companies would be one parameter. Another one is tracking the quartely reports of listed companies on stock market. Every company will tell their shareholders if they are investing in new capacities. There is no single source of data unfortunately. GST is like indirect way of measuring whether there is any investment. However, GST also includes data from all MNCs too.