He can fund a startup of AI or other manufacturers like Engine, Robotics. People will work for 80-90 hours no problem. Enrichment from both sides

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Indian Economy (40 Viewers)

- Thread starter haldilal

- Start date

More options

Who Replied?- Joined

- Jul 1, 2024

- Messages

- 4,661

- Likes

- 24,451

‘Wadia illegally sold 8.69% Tata Sons stake’

MUMBAI: A public interest litigation has alleged that Bombay Dyeing group chairman Nuslli Wadia has misappropriated 8.69% stake that FE Dinshaw Ltd owned in Tat

Looks like a major scandal is about to explode !

- Joined

- Jun 30, 2024

- Messages

- 3,367

- Likes

- 29,300

Apparently baboo s overcounted gold imports substantially.

s overcounted gold imports substantially.

View: https://x.com/business/status/1869387315128246433?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1869387315128246433%7Ctwgr%5E%7Ctwcon%5Es1_c10&ref_url=

View: https://x.com/business/status/1869387315128246433?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1869387315128246433%7Ctwgr%5E%7Ctwcon%5Es1_c10&ref_url=

- Joined

- Jul 12, 2024

- Messages

- 1,567

- Likes

- 6,223

I am not a fan of trade deficit we run every year. But I believe there is some silver lining to it. When this paper currency dollar goes to shit, you bet at some point in this century it will, then obviously Gold is the only thing which can save us from pulling us down. They have weaponized the dollar and are printing insane amounts of it every year. If you think our trade deficit is huge, take a look at America's deficit especially their budget deficit i.e., fiscal deficit.

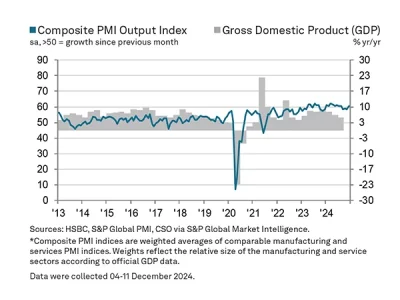

View attachment 18736

Americans are running Trillions in deficit year after year with no signs of slowing. There is no way they can pay back all that debt unless they simply print money which they always do. This year they are running $1.8 Trillion deficit. This is a ponzi scheme which at some point will collapse. When this shit goes down, every country will run to buy Gold. For the moment in time I think RBI might as well stack up some Gold reserves.

This is why the more i think of it, the more it makes sense to me that IF there is a BRICS currency, it will come in another 10-15 years minimum and it MAY be gold based.

Gold based currency will be the great equalizer of currency manipulation or economic borrowing but yes, China will be the dominant economy of the currency union, the same way Germany is but without common market.

This may be a good thing, because i am no economist, but i do notice an interesting fact about money history : most, if not all countries who are 1st world economies, got there during gold based currency era : which lasted till like 1971 in the west and like 1975 in most other economies. By then Europe, North America, Aus-NZ, Japan, Saudi were all 1st world economies.

So who else has become first world in the post 1970s world in fiat currency era ?

Answer : some of the oil kingdoms in middle east ( who like Kuwait, Qatar, UAE, Bahrain were already China-esque middle income countries by mid 70s), Singapore, Taiwan & S.Korea.

That is it.

And interestingly, there is not a single first world economy interested in the BRICS that isnt just a straight up 'gib money for oil' kingdom in the ME.

So maybe in some crazy ways, gold based currency may make sense for BRICS nations, because one thing is clear cut as to WHAT are the pros and cons of gold based currencies :

The main pro, is that currency retains value long term at a constant rate, compared to FIAT currency ( 1 GBP in 1820 = 1.33 GBP in 1920 IIRC, whereas 1 GBP in 1980 = 5 GBP in 2024.

This means, the MIDDLE CLASS engine economy : small to medium businesses etc. thrive because these businesses get to long term cost project and fix costs on even 25 year basis.

The main cons are two :

a) someone can come and cash in their paper money for a chunk of your gold, as that is what gold based currency means or at least you will have to come up with interesting legislations that may allow countries to prove gold reserve but not hand it out to maintain gold standard currency.

b) gold based currencies are less liquid than fiat currency, so the entire financial sector loses out, as they dont get to transfer insane-o amounts of money instantly as well. So the baking sector/money market people lose out massively.

From a layman's view, this seems to also be confirmed by history : America and its buddies ditched the gold currency AFTER they reached middle class dominance & opulence never seen before, perhaps foolishly thinking that even if they empower the banking class more and fuck over the middle class industrialists, the dominance attained by murrica would never be whittled away. ( which in the 1950s-1980 was in an unparallelled goldilocks zone for % industrial/goods output in human history for a country and that too at below 5% human population).

However, from BRICS perspective, who are all developing/middle income economies, empowering our middle class to be the go-getters and innovators and money-makers seems to be the way to go and that is where gold moolah is king of the hill.

- Joined

- Jul 4, 2024

- Messages

- 377

- Likes

- 2,222

Apparently baboos overcounted gold imports substantially.

View: https://x.com/business/status/1869387315128246433?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1869387315128246433%7Ctwgr%5E%7Ctwcon%5Es1_c10&ref_url=

Babus will get everyone killed one day.

- Joined

- Jul 9, 2024

- Messages

- 658

- Likes

- 1,275

Apparently baboos overcounted gold imports substantially.

View: https://x.com/business/status/1869387315128246433?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1869387315128246433%7Ctwgr%5E%7Ctwcon%5Es1_c10&ref_url=

I think real data got published, now trying to get a face saving exit.

- Joined

- Jul 1, 2024

- Messages

- 518

- Likes

- 5,040

This is why the more i think of it, the more it makes sense to me that IF there is a BRICS currency, it will come in another 10-15 years minimum and it MAY be gold based.

Gold based currency will be the great equalizer of currency manipulation or economic borrowing but yes, China will be the dominant economy of the currency union, the same way Germany is but without common market.

This may be a good thing, because i am no economist, but i do notice an interesting fact about money history : most, if not all countries who are 1st world economies, got there during gold based currency era : which lasted till like 1971 in the west and like 1975 in most other economies. By then Europe, North America, Aus-NZ, Japan, Saudi were all 1st world economies.

So who else has become first world in the post 1970s world in fiat currency era ?

Answer : some of the oil kingdoms in middle east ( who like Kuwait, Qatar, UAE, Bahrain were already China-esque middle income countries by mid 70s), Singapore, Taiwan & S.Korea.

That is it.

And interestingly, there is not a single first world economy interested in the BRICS that isnt just a straight up 'gib money for oil' kingdom in the ME.

So maybe in some crazy ways, gold based currency may make sense for BRICS nations, because one thing is clear cut as to WHAT are the pros and cons of gold based currencies :

The main pro, is that currency retains value long term at a constant rate, compared to FIAT currency ( 1 GBP in 1820 = 1.33 GBP in 1920 IIRC, whereas 1 GBP in 1980 = 5 GBP in 2024.

This means, the MIDDLE CLASS engine economy : small to medium businesses etc. thrive because these businesses get to long term cost project and fix costs on even 25 year basis.

The main cons are two :

a) someone can come and cash in their paper money for a chunk of your gold, as that is what gold based currency means or at least you will have to come up with interesting legislations that may allow countries to prove gold reserve but not hand it out to maintain gold standard currency.

b) gold based currencies are less liquid than fiat currency, so the entire financial sector loses out, as they dont get to transfer insane-o amounts of money instantly as well. So the baking sector/money market people lose out massively.

From a layman's view, this seems to also be confirmed by history : America and its buddies ditched the gold currency AFTER they reached middle class dominance & opulence never seen before, perhaps foolishly thinking that even if they empower the banking class more and fuck over the middle class industrialists, the dominance attained by murrica would never be whittled away. ( which in the 1950s-1980 was in an unparallelled goldilocks zone for % industrial/goods output in human history for a country and that too at below 5% human population).

However, from BRICS perspective, who are all developing/middle income economies, empowering our middle class to be the go-getters and innovators and money-makers seems to be the way to go and that is where gold moolah is king of the hill.

I am not sure what you are hinting at, but making currency globally acceptable is lot more than having it backed by Gold. Countries aren't necessarily want a Gold backed currency. What they want is a stable currency which does not depreciate in value and the country issuing the currency not weaponizing it for it's own interests. The Dollar needs to die or at the very least we need to cut it's size down.

- Joined

- Jul 12, 2024

- Messages

- 1,567

- Likes

- 6,223

I am not sure what you are hinting at, but making currency globally acceptable is lot more than having it backed by Gold. Countries aren't necessarily want a Gold backed currency. What they want is a stable currency which does not depreciate in value and the country issuing the currency not weaponizing it for it's own interests. The Dollar needs to die or at the very least we need to cut it's size down.

As a layman, my understanding of money is more from history of money than economic theory, so that is my preface for my conclusions.

However, what i can say, is that nature of money is, you 'cannot have it all'. You *MUST* pick one or the other in terms of either having stable currency that does not depreciate or choose a currency that is easily accessible and has greater liquidity.

You cannot have both, because to have stable currency means its fixed by *SOME* hard physical asset. that is what prevents long term value depreciation, as that physical asset is of finite X quantity, where mass of x does not change by more than a tiny % point per annum.

If you do this, you take away liquidity and money becomes finite and to get rich, someone must get poor, etc etc. because money is fixed to a physical asset ( gold, platinum, oil, whatever) and that physical asset is also in finite supply globally, so country X getting rich must mean countries Total - X must also get poorer.

If you dont want this, you must de-link curerncy from asset and make it fiat currency. Which means he who controls the dominant currency of the world ( USD currently) gets to create money outta thin air, thus increasing supply of money continuously over time, which means money also is worth less over time, aka not stable and one that depreciates.

There is no other route. The weaponisation of currency is more to do with which currency is king of the hill for global reserve + trade, not what type of currency it is - gold or fiat.

The dollar hegemony will end in our lifetime but it wont die - it will simply become one of the main currencies because murrica is still gonna be a powerful economy in economic metrics no matter what and wont just fade away to become like latin america shitholes.

- Joined

- Jul 1, 2024

- Messages

- 1,971

- Likes

- 11,784

Apparently baboos overcounted gold imports substantially.

View: https://x.com/business/status/1869387315128246433?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1869387315128246433%7Ctwgr%5E%7Ctwcon%5Es1_c10&ref_url=

View: https://twitter.com/Saiarav/status/1869625219138416929

View: https://twitter.com/Saiarav/status/1869601845037175229

It gets crazier.

Unfortunately, this clownery has pushed INR into the gutter for no reason at all.

I am tired of writing this but appointing lampposts to the cabinet DOES NOT HELP.

- Joined

- Jul 1, 2024

- Messages

- 396

- Likes

- 2,682

View: https://x.com/BrownPoints/status/1869680858015121861

View: https://x.com/deedydas/status/1869647888273531260

I wonder when will our subhuman municipal babus start to do even 1% of the work they are supposed to do. Indian cities are the absolute toilets of the world thanks to them. Out of hundreds of cities, you can count in 1 hand the number of them which are clean and have nice paved roads. Most of our cities are overgrown villages with a few shiny buildings in between. Our complete lack of urban investment + 0 accountability of municipal governance is killing probably 2-3% of gdp growth each year. Just making the cities clean with paved roads and footpaths, and banning honking will improve QOL multifold, but our babus can't even do that.

- Joined

- Jul 1, 2024

- Messages

- 1,971

- Likes

- 11,784

View: https://x.com/BrownPoints/status/1869680858015121861

View: https://x.com/deedydas/status/1869647888273531260

I wonder when will our subhuman municipal babus start to do even 1% of the work they are supposed to do. Indian cities are the absolute toilets of the world thanks to them. Out of hundreds of cities, you can count in 1 hand the number of them which are clean and have nice paved roads. Most of our cities are overgrown villages with a few shiny buildings in between. Our complete lack of urban investment + 0 accountability of municipal governance is killing probably 2-3% of gdp growth each year. Just making the cities clean with paved roads and footpaths, and banning honking will improve QOL multifold, but our babus can't even do that.

What a way to karma firm, haha. But honestly, you want a great experience in India? Pay more! It is that simple. India's tourism industry does not depend on outsiders (unlike vietnam, kenya etc where domestic tourism is non existent and the industry takes pride in their ability of being budget friendly) - if the tourist does not spend he/she will be treated like nobodies - does not really matter if you are a foreigner or not.

If you want to cope, post how the gormint is falling well short of their own capex targets. Or how their divestment targets are so pitifully modest (proceeds of which can be spent on infra etc).

Not this! Too many cheapskates expect to be treated like royalty in here. Do not like it here? Do not come. It is not at all easy to secure or extend an Indian visa (unlike, Vietnam etc where tourists are prioritized) - assuming the user to be a genuine tourist (and not a larper), dafuq he/she was spending 3 years in a nation he/she didn't like for?

- Joined

- Jul 2, 2024

- Messages

- 86

- Likes

- 306

View: https://x.com/BrownPoints/status/1869680858015121861

View: https://x.com/deedydas/status/1869647888273531260

I wonder when will our subhuman municipal babus start to do even 1% of the work they are supposed to do. Indian cities are the absolute toilets of the world thanks to them. Out of hundreds of cities, you can count in 1 hand the number of them which are clean and have nice paved roads. Most of our cities are overgrown villages with a few shiny buildings in between. Our complete lack of urban investment + 0 accountability of municipal governance is killing probably 2-3% of gdp growth each year. Just making the cities clean with paved roads and footpaths, and banning honking will improve QOL multifold, but our babus can't even do that.

Fkr wrote 1.6 billion instead of 1.4 wignats always overestimate our population

- Joined

- Jul 1, 2024

- Messages

- 396

- Likes

- 2,682

What a way to karma firm, haha. But honestly, you want a great experience in India? Pay more! It is that simple. India's tourism industry does not depend on outsiders (unlike vietnam, kenya etc where domestic tourism is non existent and the industry takes pride in their ability of being budget friendly) - if the tourist does not spend he/she will be treated like nobodies - does not really matter if you are a foreigner or not.

If you want to cope, post how the gormint is falling well short of their own capex targets. Or how their divestment targets are so pitifully modest (proceeds of which can be spent on infra etc).

Not this! Too many cheapskates expect to be treated like royalty in here. Do not like it here? Do not come. It is not at all easy to secure or extend an Indian visa (unlike, Vietnam etc where tourists are prioritized) - assuming the user to be a genuine tourist (and not a larper), dafuq he/she was spending 3 years in a nation he/she didn't like for?

Do you want to have a great experience in Somalia? Pay more!

Well most of the tweet is fully correct. The moment you exit the hotel, you are still overwhelmed by the litter, filth and trash piles. Why would they pay extra to come here when they can go to other countries? And more and more indians themselves are travelling abroad instead of locally due to the same reasons. Good luck trying to mitigate this deficit while still having a large trade deficit

- Joined

- Jul 1, 2024

- Messages

- 396

- Likes

- 2,682

Matix Fertilisers to invest ₹7,500 crore to double urea production capacity

Matix Fertilisers plans to double urea production capacity, investing ₹7,500 crore to expand market share in India.

- Joined

- Jul 1, 2024

- Messages

- 1,971

- Likes

- 11,784

Do you want to have a great experience in Somalia? Pay more!

Of course India and Somalia are totally comparable. Fully agree!

Well most of the tweet is fully correct. The moment you exit the hotel, you are still overwhelmed by the litter, filth and trash piles. Why would they pay extra to come here when they can go to other countries?

Then no need to come? Given India does not call itself 'budget friendly' to begin with?

I see an entire genre of SM posts/YT videos/'travel vlogs' dedicated to praising India and earning views from Indian users. And one other dedicated to maligning/ragebaiting India, Indians and farming views in a similar fashion.

It is only natural to suspect that the avg 'phoren goroid tourist vlogger/influencer/reviewer' is not even here to 'travel' in the first place.

And more and more indians themselves are travelling abroad instead of locally due to the same reasons. Good luck trying to mitigate this deficit while still having a large trade deficit

That more and more Indians are travelling abroad for reasons you find compelling and are affecting the trade deficit in any meaningful manner is a wild claim and needs some citation.

- Joined

- Jul 1, 2024

- Messages

- 2,360

- Likes

- 14,525

View: https://twitter.com/Saiarav/status/1869625219138416929

View: https://twitter.com/Saiarav/status/1869601845037175229

It gets crazier.

Unfortunately, this clownery has pushed INR into the gutter for no reason at all.

I am tired of writing this but appointing lampposts to the cabinet DOES NOT HELP.

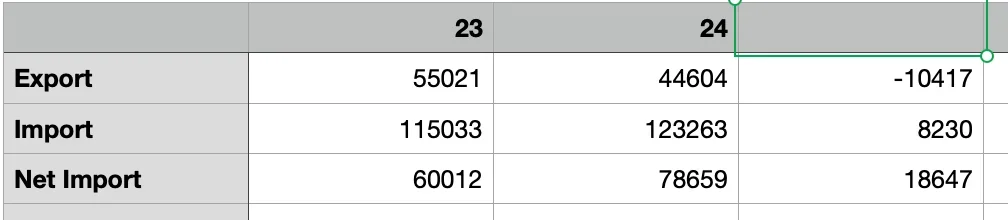

since this is a SM theory, looked into this even though it's not a good idea to take provisional numbers too seriously this early.

it may not be the case of accounting error entirely.

Quick estimates from commerce ministry

petroleum exports dropped by 10 billion $.

highlights are that major drops are :

U.S - 1.2 billion $

West Asia + Africa - 6 billion $

within west asia

Israel - 1.9 billion $ (just 2 million $ export so far this year)

these four geographies alone is about 7.2 billion $ drop.

netherlands have increased their imports to 10.3 billion $.

2023-24 (Apr-Nov)

https://niryat.gov.in/#?start_date=...ort-desc&commodity_group_id=3&commodity_id=18

2024-25 (Apr-Nov)

Last edited:

- Joined

- Jul 1, 2024

- Messages

- 1,971

- Likes

- 11,784

How exactly can net petro imports balloon to such an extent with nobody ever batting an eyelid even in a provisional estimate despite falling global prices? Gross incompetence is the only compelling answer.since this is a SM theory, looked into this even though it's not a good idea to take provisional numbers too seriously this early.

it may not be the case of accounting error entirely.

Quick estimates from commerce ministry

View attachment 18968

petroleum exports dropped by 10 billion $.

highlights are that major drops are :

U.S - 1.2 billion $

West Asia + Africa - 6 billion $

within west asia

Israel - 1.9 billion $ (just 2 million $ export so far this year)

these four geographies alone is about 7.2 billion $ drop.

netherlands have increased their imports to 10.3 billion $.

2023-24 (Apr-Nov)

https://niryat.gov.in/#?start_date=...ort-desc&commodity_group_id=3&commodity_id=18

2024-25 (Apr-Nov)

- Joined

- Jul 1, 2024

- Messages

- 2,360

- Likes

- 14,525

How exactly can net petro imports balloon to such an extent with nobody ever batting an eyelid even in a provisional estimate despite falling global prices? Gross incompetence is the only compelling answer.

exports dropping by 10.4 billion is making the net number look big, imports growing at their normal 8-10% pace.

check the niryat link in the post.

petro exports by year(apr to nov).

21 - 37 B $

22 - 60 B$

23 - 52 B$

24 - 40 B$ (P)

this is a trend.

- Joined

- Jul 1, 2024

- Messages

- 1,971

- Likes

- 11,784

Exports dropping are on expected lines (because prices of petro products have fallen globally) - the decline is not so much about volumes. It is also why the import nos look sus - both should have counterbalanced each other.exports dropping by 10.4 billion is making the net number look big, imports growing at their normal 8-10% pace.

check the niryat link in the post.

petro exports by year(apr to nov).

21 - 37 B $

22 - 60 B$

23 - 52 B$

24 - 40 B$ (P)

this is a trend.

Users who are viewing this thread

Total: 38 (members: 15, guests: 23)

Latest Replies

-

Indian Economy

- concard

-

DRDO & PSUs

- KAB7777

-

Jokes Thread

- haldilal

-

Indian Small Arms and Weapons

- Unknowncommando

-

Operation Sindoor & Aftermath

- indrajit

-

Indo US Relations

- shade2