What do you mean?as long as they're not putting aluminum and mercury, or using aborted fetal cell lines, this should be ok

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Indian Economy (23 Viewers)

- Thread starter haldilal

- Start date

More options

Who Replied?- Joined

- Dec 3, 2024

- Messages

- 24

- Likes

- 73

‘Suzuki to establish Gujarat as its global export hub’ | Ahmedabad News - The Times of India

Ahmedabad: Gujarat is set to become the hub of Suzuki's global exports, according to Kinji Saito, director of Suzuki Motor Corporation (SMC) in Japan.

Gujarat is set to become the hub of Suzuki's global exports, according to Kinji Saito, director of Suzuki Motor Corporation (SMC) in Japan. By setting up the second car manufacturing plant in Gujarat with a capital infusion of Rs 35,000 crore and a capacity for manufacturing 1 million cars, the state will be a key export hub to Africa, Europe, and Latin American countries, Saito told TOI.

He was in Ahmedabad on Monday to deliver an inspirational lecture on ‘Osamu Suzuki: Life, Leadership, Legacy'. Osamu Suzuki, the former chairman of SMC, died at the age of 95 on Dec 25 last year.

The company is currently scouting for a land parcel in Gujarat for setting up the new plant, according to sources familiar with the development.

"It was after the meeting between Osamu Suzuki and PM Narendra Modi, who was the chief minister of Gujarat back in 2007, that SMC expanded its manufacturing presence in Gujarat. Now with the second plant, it is poised to become a global export hub. By 2030, Maruti Suzuki plans to manufacture 4 million cars in India, of which 1 million will be exported, and Gujarat will be at the centrestage for these exports," Saito told TOI.

- Joined

- Jan 5, 2025

- Messages

- 153

- Likes

- 694

MP has had like 20 straight years of BJP rule and still looks like and by most metrics still is, a dump. Minor improvements in education and healthcare, but nothing substantial. Sad.

Well for massive investments to flow infrastructure has to be ready. MP has build massive road network in these years. And those are good quality roads.

Now expressways are coming up.

Still shivraj was not able to transform administrative suitable for rapid growth.

That is why mohan yadav was put forward by rss. And he is doing administrative surgery.

He is introducing rapid changes in administrative process like land registration can now be done online, no need to wait at registrar office forever. Land nomination will follow automatically. No need to bother for that.

For investment he is organising regional conclaves and have been successful till now.

Yet for big ticket investments MP need to enlarge it's metros . So one important step has been to enlarge Indore metropolitan area with inclusion of area from surrounding districts.

I guess this will be repeated for bhopal , gwalior and jabalpur too.

Yet it's still a long way for MP.

- Joined

- Dec 26, 2024

- Messages

- 130

- Likes

- 456

View: https://youtu.be/PzsCQ152FRg?si=hLhXQeOvxTtx0X6b

Another country following the export model to get rich while our political leaders and economists still neglect manufacturing in favour of service's.

The year is 2050 and the export model is still making countries rich while in India niti ayyog has set up another committee to try to increase the manufacturing % of GDP to 25%

Nandan Nilekani may finally change his mind on LLMs after reading this

So much for being "major defense partner", "strategic partnership" etc etc that is placed in the same category as "enemy".

View attachment 21879

View: https://x.com/AravSrinivas/status/1881627701737574755?t=VKTX5GwklzFqm52t-wzrQw&s=19

India's economy slows down just when it was supposed to speed up

With major stock market correction too general news of late hasn't been great, GDP target also might be missed. Is this just a phase or a trend now?

A year ago, India was bouncing back from a recession caused by COVID-19 with a spring in its step. The country had overtaken China as the most populous country, and its leaders were declaring India the world's fastest-growing economy

This was music to the ears of foreign investors and to India's prime minister, Narendra Modi, who at every opportunity boasted about his country's inevitable rise. Home to 1.4 billion people, an invigorated India could become an economic workhorse to power the rest of the world, which is stumbling through the fog of trade wars, China's troubles and Russia's invasion of Ukraine.

India displaced Britain in 2022 as the world's fifth-biggest economy, and by next year it is expected to push aside Germany in fourth spot. But India has lost a step, revealing its vulnerabilities even as it moves up the global rankings.

The stock market, which soared for years, has just erased the past six months of gains. The currency, the rupee, is falling fast against the dollar, making homegrown earnings look smaller on the global stage. India's new middle class, whose wealth surged like never before after the pandemic, is wondering where it went wrong. Modi will have to adjust his promises.

November brought the first nasty shock, when national statistics revealed that the economy's annual growth had slowed to 5.4 per cent over the summer. Last fiscal year, which ran from April through March, was clocked at 8.2 per cent growth, enough to double the economy's size in a decade. The revised outlook for the current fiscal year is 6.4 per cent.

"It's a reversion to trend," according to Rathin Roy, a professor at the Kautilya School of Public Policy in Hyderabad. There was a brief period, 20 years ago, when India seemed poised to break into double-digit growth. But, Roy argued, that growth depended on banks pumping out loans to businesses at an unsustainable rate.

Ever since the government withdrew vast amounts of cash from circulation in 2016 in a vain effort to rein in underground commerce, Roy said, the economy has never recovered even its 8-per-cent pace. It only looked better, he said, because "you had the COVID dip, as happened in many economies. India's economy didn't get back in absolute size until last year," later than most other countries.

The reasons behind the slowdown are up for debate. One effect is undeniable: Overseas investors have been heading for the exits.

"Foreign investment has taken the call that the Indian stock market is overvalued," Roy said. "It's quite logical that they would get out of pesky emerging economies and put their money where they can make more," like on Wall Street, he added.

Investors who bought a broad mix of Indian stocks early in 2020 watched their worth triple by September 2024, as major market indexes hit record highs.

The number of Indians buying stocks grew even more rapidly, which helped drive up prices. Before the parliamentary election in June, Modi's right-hand man, Amit Shah, predicted that India's new investor class would help sweep their party to victory. During Modi's first two terms, the number of Indians holding investment accounts went from 22 million to 150 million, according to a study by Motilal Oswal, a brokerage house.

"These 130,000,000 people will be earning something, no?" Shah reasoned to The Indian Express, a newspaper. The new investors were clearly spending. In particular, the luxury and other high-end sectors were doing well: cars more than motorcycles, high-end electronics more than household basics.

But that prosperity, concentrated among the top 10 per cent, left the other 90 per cent wanting more. Modi's party lost its majority in parliament, though it retained control of the government. Expanded welfare payments, like the free wheat and rice the government distributed to 800 million people, helped.

Despite such programs, the Modi government has been fiscally conservative and keeps a watchful eye on inflation. It has focused spending on big-ticket infrastructure items, such as bridges and highways, that are supposed to entice private enterprise into making investments of their own.

Indian businesses still have to contend with excessive red tape, political interference and other familiar difficulties. The Modi government has tried to reduce those burdens, but in recent years it has focused on increasing economic supply.

India's government bet big on building new airports, for example. But the airlines that were set to serve them are pulling out. Vacationers who would have flown to beachy places like Sindhudurg, between Mumbai and Goa, are not buying enough tickets to keep a terminal there open.

Arvind Subramanian, an economist at the Peterson Institute for International Economics in Washington, traces the lack of demand back to the broader state of employment.

"Jobs are not being created, so people don't have incomes, and wages are depressed," he said. There aren't enough stockholders to make up the difference. The national minimum wage, which many workers in the informal economy are never paid, is just $2 a day.

Subramanian, who was the country's chief economic adviser during Modi's first term, said the government has gone "stale, and bereft" of ideas for tackling such problems. "Ideas for long-term growth and boosting employment -- that is what we're missing now," he said.

He thinks the rupee's fall is only natural and should have happened sooner. Until recently, the central bank was spending billions of dollars to prop up the value of the national currency.

The psychological effect of a weakening rupee can be painful, but the cost of keeping it at a fixed rate of exchange to the dollar was "extremely damaging for the national economy," he said.

No one is happy to see growth slowing. The government's current chief economic adviser, V Ananta Nageswaran, said at a news briefing in November that the bad news could be a blip. "The global environment remains challenging," he said, with a strong dollar and suspense over the possibility of sudden policy moves in the United States and China.

A year ago, the hope was that India's own economic engine could push it through the global headwinds. The missing ingredients, then as now, start with too many people having too little money in hand.

"There simply isn't enough demand," said Roy, the professor in Hyderabad. "The idea that you can expect supply to create its own demand has its limits," he said.

"Regular people," Roy said, those between the top 10 per cent seeing big stock market gains and the bottom 50 per cent struggling to get by, still "don't earn enough to buy the basics." About 100 million of these regular people qualify for free grain.

The government is expected to release a budget for the new fiscal year Feb. 1. Nageswaran has stirred hope that it may include tax cuts, putting more money in the hands of consumers.

"This idea that India needs tax cuts, it has the causation exactly wrong and reversed," Subramanian said. "Consumption is weak because incomes are weak."

Last month, Nageswaran told Assocham, a group of business leaders, that employers need to pay their workers more, noting that wages were stagnant. "Not paying workers enough will end up being self-destructive or harmful for the corporate sector itself," he warned.

With major stock market correction too general news of late hasn't been great, GDP target also might be missed. Is this just a phase or a trend now?

Tax looting average economic growth no real reforms but who cares when you can have laser eyes for reels.

View: https://x.com/sandipsabharwal/status/1881675168411697616?s=46

View: https://x.com/sandipsabharwal/status/1881675168411697616?s=46

Last edited:

- Joined

- Jun 27, 2024

- Messages

- 1,610

- Likes

- 7,710

Tax looting average economic growth no real reforms but who cares when you can have laser eyes for reels.

View: https://x.com/sandipsabharwal/status/1881675168411697616?s=46

Didn't the left parrot an argument that stock market should not be equated to national economy when the market was making new highs?

It is investor strategy to disinvest when there is lack of global and economic policy of India has very less to do with it.

Not to mention there is a lot of speculation In market.

The whole world is waiting for what's to come after trump is here, besides America lot of countries had elections this year.

global investor are waiting for the resolution of Ukriane Russia war and how trump is going to impose tarrifs.

The tata has its leadership refreshed and investors are waiting as to how the new leader approaches the industry.

After election and even before it lots of chapri investors entered the market and gave enough liquidity for the FII and DII to sell their holdings.

These economist aren't ignorant they are just malicious and want to keep the Indian Investor in a constant state or Chapri.

- Joined

- Jul 1, 2024

- Messages

- 2,044

- Likes

- 12,235

Didn't the left parrot an argument that stock market should not be equated to national economy when the market was making new highs?

It is investor strategy to disinvest when there is lack of global and economic policy of India has very less to do with it.

Not to mention there is a lot of speculation In market.

The whole world is waiting for what's to come after trump is here, besides America lot of countries had elections this year.

global investor are waiting for the resolution of Ukriane Russia war and how trump is going to impose tarrifs.

The tata has its leadership refreshed and investors are waiting as to how the new leader approaches the industry.

After election and even before it lots of chapri investors entered the market and gave enough liquidity for the FII and DII to sell their holdings.

These economist aren't ignorant they are just malicious and want to keep the Indian Investor in a constant state or Chapri.

The reason why phoren investors are exiting is basically this;

Trump gets eleceted -> promises batshit crazy econ/trade policies which in turn expected to facilitate higher inflation -> inflation nos already acting up -> Fed expected to cut less -> money pours into burgerland -> bond yields are borderline nonsensical -> US$ gets strengthened like crazy

We will probably get away with a 7%ish real growth but how do you even fight back against this shitshow?

Does it make any sense?

Nothing to do with 'taxation fears'. How these posts manage to gather thousands of likes is something I will never understand (yeah, I know xitter is infested with bots but still).

Last edited:

- Joined

- Jun 27, 2024

- Messages

- 1,610

- Likes

- 7,710

But this guy seems like a good analyst otherwise but somehow want to put gormint under the bus.The reason why phoren investors are exiting is basically this;

Nothing to do with 'muh taxation fears'.

Maybe he had a narrative to sell.

Experts and watchers were warning that if corporate results are not along expected lines you can expect even more corrections. General sentiment seems to be that stock market here is overvalued currently.Didn't the left parrot an argument that stock market should not be equated to national economy when the market was making new highs?

It is investor strategy to disinvest when there is lack of global and economic policy of India has very less to do with it.

Not to mention there is a lot of speculation In market.

The whole world is waiting for what's to come after trump is here, besides America lot of countries had elections this year.

global investor are waiting for the resolution of Ukriane Russia war and how trump is going to impose tarrifs.

The tata has its leadership refreshed and investors are waiting as to how the new leader approaches the industry.

After election and even before it lots of chapri investors entered the market and gave enough liquidity for the FII and DII to sell their holdings.

These economist aren't ignorant they are just malicious and want to keep the Indian Investor in a constant state or Chapri.

- Joined

- Jul 1, 2024

- Messages

- 1,896

- Likes

- 10,222

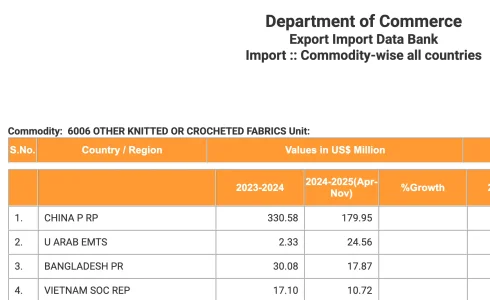

one of the biggest wool these JNU marxist economists pulled over Indian public's eyes, is that they managed to conflate entire textile supplychain with RMG and domestic RMG production with RMG exports. so much so that we keep forgetting, domestic textile industry is worth 12 lakh crore and RMG is one component not all of it, and annual estimate of india's domestic RMG production for local consumption is so hard to find on the web.

Valuation of India's textile sector has crossed Rs 12 lakh crore, says PM Modi as he promises support

More than 3,000 exhibitors—3,000 buyers from 100 nations and 40,000 trade visitors—had participated in the event, PM said.www.deccanherald.com

I am definitely not agreeing with our Commie Economist here. But our Textile production is still an underperforming asset where we relied on Bangbros to get latest chaddi baniyans meanwhile chad UP, Bihar talks nonsense for year ideally sitting in huge population which needs job.

Even today in Tiruppur we are building small scale units in multiple areas and it is basically an village with factories. On the other Vietnam they build an huge ass Planned SEZ and allow companies to scale up.

GOI passing the Labor Code but still BJP states did not pushed them. Sad state where certain policies on paper looks gamechanger but subsequent execution is dogshit.

Meanwhile Commie sir does not want to talk about reservation to avoid backlash so on so.

- Joined

- Jan 5, 2025

- Messages

- 153

- Likes

- 694

Tax looting average economic growth no real reforms but who cares when you can have laser eyes for reels.

View: https://x.com/sandipsabharwal/status/1881675168411697616?s=46

Sensex was @40000 pre covid. It fell in corona and rose with recovery. Since than it has rose to 82000 doubles in mere 4 years timeframe from 2020-2024.

Correction is natural and so is profit booking. Those foreigners are merely reaping the rewards of investing in covid fall and will be back when market returns to less inflated normal levels. Over inflated markets are not good for anyone other than scammers.

- Joined

- Jul 1, 2024

- Messages

- 2,044

- Likes

- 12,235

See, this argument is repeated everytime INR and/or Indian markers are down. It is always the Indian market/curency that is 'overvalued' and 'needs corrections' - not the other way around!Experts and watchers were warning that if corporate results are not along expected lines you can expect even more corrections. General sentiment seems to be that stock market here is overvalued currently.

Are the big amreeki companies fairly valued? Are Tesla, NVIDIA fairly valued? Does the US$ bond yield make any sense?

- Joined

- Jun 27, 2024

- Messages

- 4,318

- Likes

- 25,277

Ya'll Nibbiars with the commission of BMCT phase II of 24 lakhs TEU's per annum and NSFT upgradations of 12 lakh TEU's PA inauguration yesterday to the existing 70.5 lakh TEU's PA, the JNPA is now the largest Container with 1.1 Crore TEU's PA and overall Port in India with the new Capacity to reach it's limits by 2027 itself.

- Joined

- Jun 27, 2024

- Messages

- 2,998

- Likes

- 10,712

I'm sorry I didn't realize there was a correlation between education, healthcare, hygiene, other things, and industry

MP was once a Bimaru State lacking on majority of the socio-economical factors. But 20 years of BJP rule has taken if out of Bimaru list.

State has close to 24-hour electricity availability. Its cities are regularly listing in cleanest cities in India. They are not as fast in Industrialization as some major ones but they are definitely not in same leagues as Bihar and other current Bimaru states.

Most things have improved in the state and it likes to lay low in terms of creating news. But that does not mean MP is not doing anything at all.

It used to be one of the largest budget surplus state before Mamaji brought Ladli yojana which made budget barely breakeven.

State has close to 24-hour electricity availability. Its cities are regularly listing in cleanest cities in India. They are not as fast in Industrialization as some major ones but they are definitely not in same leagues as Bihar and other current Bimaru states.

Most things have improved in the state and it likes to lay low in terms of creating news. But that does not mean MP is not doing anything at all.

It used to be one of the largest budget surplus state before Mamaji brought Ladli yojana which made budget barely breakeven.

Last edited:

- Joined

- Jan 5, 2025

- Messages

- 153

- Likes

- 694

See, this argument is repeated everytime INR and/or Indian markers are down. It is always the Indian market/curency that is 'overvalued' and 'needs corrections' - not the other way around!

Are the big amreeki companies fairly valued? Are Tesla, NVIDIA fairly valued? Does the US$ bond yield make any sense?

US stock markets are in unprecedented bubble. 50 trillion valuation!!

Even within that valuation giant tech companies now account for almost 40% of nasdaq100 and 20% of s&p.

This might end up like dotcom bubble.

- Joined

- Jul 1, 2024

- Messages

- 2,433

- Likes

- 14,954

But our Textile production is still an underperforming asset where we relied on Bangbros to get latest chaddi baniyans meanwhile chad UP, Bihar talks nonsense for year ideally sitting in huge population which needs job.

Even today in Tiruppur we are building small scale units in multiple areas and it is basically an village with factories. On the other Vietnam they build an huge ass Planned SEZ and allow companies to scale up.

GOI passing the Labor Code but still BJP states did not pushed them. Sad state where certain policies on paper looks gamechanger but subsequent execution is dogshit.

Meanwhile Commie sir does not want to talk about reservation to avoid backlash so on so.

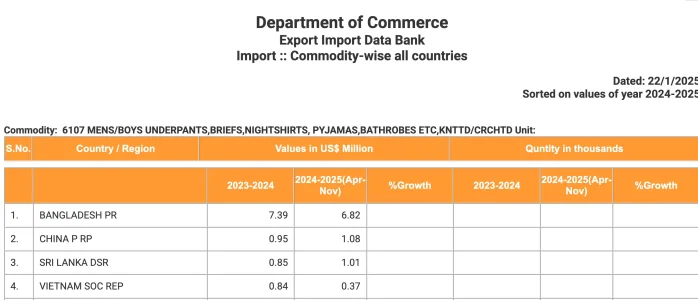

are you sure, you are not over reacting for something which is not even crossing 1000 crores of import per annum.

chaddi from BD is 7 million $ import,

for baniyan import from BD (not sure which is the exact HSN code), even if both combined it is 80 million $ 690 crore.

and let's not forget, 25% of BD textiles mills are largely owned by Indians.

- Joined

- Jul 1, 2024

- Messages

- 1,115

- Likes

- 3,730

- Joined

- Jun 30, 2024

- Messages

- 3,544

- Likes

- 30,552

Users who are viewing this thread

Total: 18 (members: 6, guests: 12)

Latest Replies

-

Indian Special Forces

- Unknowncommando

-

-

Report Bugs

- Bhartiya Sainik

-

Air India AI 171 Crash in Ahmedabad

- Bhartiya Sainik

-

Indian Economy

- snakeeyes07

-

DRDO & PSUs

- fire starter