- Joined

- Jul 3, 2024

- Messages

- 771

- Likes

- 367

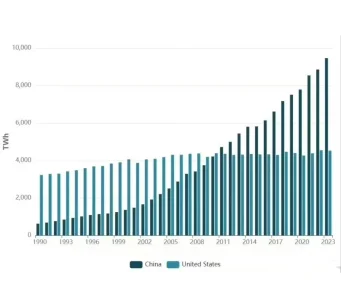

China's growth strategy, characterized by heavy subsidization and deliberate financial losses to gain market dominance, raises significant concerns about its long-term sustainability. While this approach has allowed Chinese companies to capture substantial market share in industries such as steel, solar panels, and telecommunications, the reliance on aggressive pricing and government support can lead to economic inefficiencies. For instance, by selling products at or below cost to outcompete global rivals, Chinese firms often prioritize short-term market share over profitability, potentially creating unsustainable financial practices and overcapacity within these sectors.

Moreover, the strategy of leveraging economies of scale and dominating global supply chains, while effective in the short term, may contribute to long-term vulnerabilities. The extensive use of dumping practices, where products are sold in foreign markets at lower prices than in the domestic market, can undermine international competitors and lead to industry consolidation. However, this aggressive approach also risks provoking trade tensions and retaliatory measures from other countries, as seen in the escalating trade conflicts with the United States and the European Union. These tensions could disrupt global markets and diminish China's ability to sustain its growth.

Ultimately, the heavy reliance on subsidies and state intervention in strategic industries may lead to financial imbalances, such as high levels of corporate debt and economic inefficiencies. As China continues to push its influence through initiatives like the Belt and Road Initiative, the potential for geopolitical resistance grows, further challenging the long-term viability of its growth strategy. While this approach has brought China significant economic power, its sustainability is increasingly questioned, particularly as global powers seek to counterbalance China's influence in the world economy.

This Indian state is offering added subsidies for semiconductor manufacturing - CNBC TV18

Uttar Pradesh unveils Semiconductor Policy 2024, offering substantial subsidies and exemptions to attract investors for semiconductor units. Policy includes incentives for R&D centres, skills training, and electricity duty exemption, aiming to boost electronics manufacturing in the state.

Without subsidies, India would never have been able to build a semiconductor industry.

The same goes for other countries