Chinese Economy Watch (5 Viewers)

- Thread starter rockdog

- Start date

More options

Who Replied?Seems like the debt induced growth strategy is starting to show cracks.

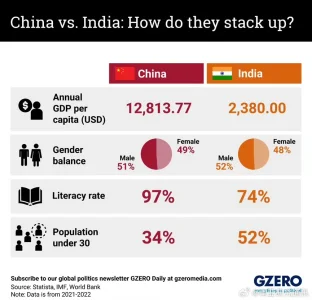

The concept of debt works when you can borrow against the future. Debt doesn't work if the future looks bleak because of population decline. So the strategy that worked for the last 4 decades will no longer work for China. What is the new strategy?

More industrilized population, more high quality population. More woman participantion in work.

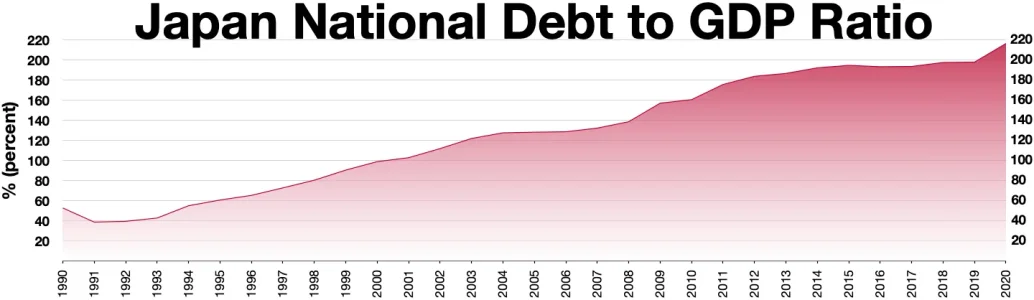

You didn't answer my question. You can't borrow against the future if the future is a declining population. Women in the workforce gives you a temporary boost but long term the TFR rates plummet, as we can see in South Korea, Japan which leads to stagnation. So you can't borrow against that future growth in China. So you have to outsource that growth to high TFR rate countries like Japan does to maintain it's GDP through investment. China is trying that through BRI, but it's not very lucrative for the countries receiving it.More industrilized population, more high quality population. More woman participantion in work.

View attachment 8082

View attachment 8081

All your stats are meaningless if long term there is no answer to population decline. US fixes this by encouraging immigration into the country, which has it's own set of problems. US also outsources their currency to the rest of the world, which China doesn't do. So what is China's long term strategy. If your provinces don't have enough money to pay salaries to their employees, that is a bad signal.

Last edited:

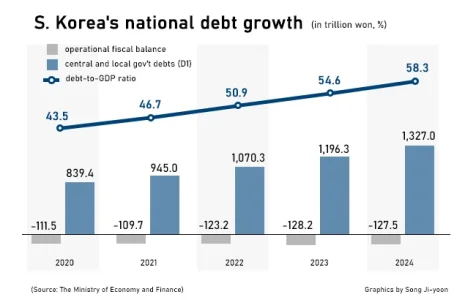

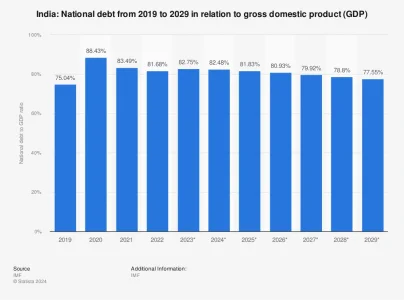

India can afford the 96% debt because of the high TFR. China cannot. US deals with it because of the petrodollar. China's outcome will be similar to Japans when the population starts declining. What is the debt ratio for South Korea and Japan?

- Joined

- Jul 1, 2024

- Messages

- 4,724

- Likes

- 24,787

View: https://twitter.com/Noahpinion/status/1829407846209143220?s=19

This snippet perfectly encapsulates the reason wumaos keep flocking here just as it highlights the reason why the CCP pretends to be nonchalant & dismissive about India while in fact they're spooked about us especially under Modi .

Do read the interview too . It's quite long but extremely rewarding.

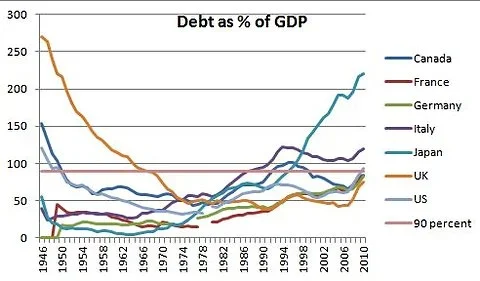

The reason this occurs is that the government expenditure for social security exceeds it's income from tax revenues and other income streams. Therefore the government must borrow against the future to operate today. You can see the pattern in South Korea and Japan.

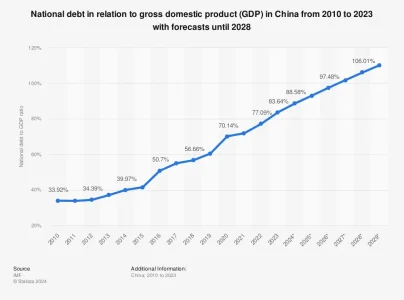

Lets look at China.

Now look at India

As of 2024, India will be a fiscal surplus budget if you account for the foreign remittances from India diaspora. Those remittances are $120B in 2023 or 3.5% of GDP. Current fiscal deficit in India is 5.3% of GDP, so it only needs to borrow about 1.8% from the future. However, from 2025 onwards, India can probably start paying down the debt, the same cannot be said about China.

Because India is a free society, in the future it can attract people through immigration as well.

Last edited:

Debt will keep increasing for China and it will feel a lot of pain in the next few years. This is why US is opening the flood gates to immigration (legal and illegal) right now, it is keeping it's debt lower by importing more people.

- Joined

- Jul 1, 2024

- Messages

- 1,703

- Likes

- 6,455

It will only work in short term but it will have long lasting effects in that it would only spur Chinese to develop its own ASLM technology base and create a formidable competitor. China do have the means to replicate ASML and its vendor on a massive scale. The only country that can do that.

US brought down it's national debt through immigration. UK brought it down through immigration. All the countries with bad immigration policies have bad national debt to gdp ratio. Japan just recently announced an immigration policy where it is encouraging Indians to move to Japan.

EU sort of masked this issue for a long time because of their socialist policies and high tax rates, but even with roughly 2x the tax rate + collection their GDP to debt ratio is pretty bad.

- Joined

- Jul 1, 2024

- Messages

- 1,703

- Likes

- 6,455

Your stats are wrong. India’s national debt is around $2.1T not $3.3T.More industrilized population, more high quality population. More woman participantion in work.

View attachment 8082

View attachment 8081

- Joined

- Jul 1, 2024

- Messages

- 1,866

- Likes

- 10,014

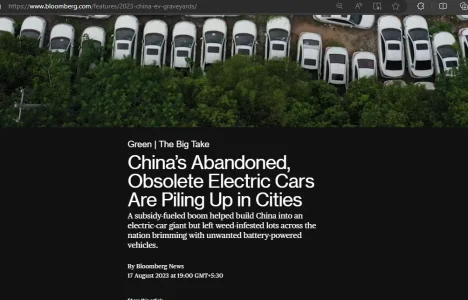

Too much excess capital available for these Flying taxis by choking the population down. No stocks, no housing market. Free money for garbage worthy products. Flying taxis will end up in similar graveyards like shareRide EVs

Wumaoson is peddling more fake info about debt to GDP. China's real debt is hidden in provincial financial instruments. which is about 180% of the national GDP if we remove central debt of 100%. On the other hand Indian provinces are financially stable with 30-50% of debt to SGDP.

https://www.reuters.com/breakingviews/chinas-growth-is-buried-under-great-wall-debt-2023-09-13/

...In the 15 years since, China's debt-to-GDP ratio has doubled to a whopping 280% , opens new tab, with the bulk of liabilities held by local government financial vehicles

(LGFVS).

Wumaoson is peddling more fake info about debt to GDP. China's real debt is hidden in provincial financial instruments. which is about 180% of the national GDP if we remove central debt of 100%. On the other hand Indian provinces are financially stable with 30-50% of debt to SGDP.

https://www.reuters.com/breakingviews/chinas-growth-is-buried-under-great-wall-debt-2023-09-13/

...In the 15 years since, China's debt-to-GDP ratio has doubled to a whopping 280% , opens new tab, with the bulk of liabilities held by local government financial vehicles

(LGFVS).

Last edited:

You didn't answer my question. You can't borrow against the future if the future is a declining population. Women in the workforce gives you a temporary boost but long term the TFR rates plummet, as we can see in South Korea, Japan which leads to stagnation. So you can't borrow against that future growth in China. So you have to outsource that growth to high TFR rate countries like Japan does to maintain it's GDP through investment. China is trying that through BRI, but it's not very lucrative for the countries receiving it.

All your stats are meaningless if long term there is no answer to population decline. US fixes this by encouraging immigration into the country, which has it's own set of problems. US also outsources their currency to the rest of the world, which China doesn't do. So what is China's long term strategy. If your provinces don't have enough money to pay salaries to their employees, that is a bad signal.

Most Chinese debt are Internal debt, if the debt is internal, it's infact kind of seigniorage.

US can print money because of its dollar hegemony make the whole world to pay the bill, RMB also can be somehow over printed, it's because China has strongest manufacture and can export to the whole world.

China actually can borrow the future if the manufacture keep on growing, China manufacture in world share greq from 17% to 30% within last 15 yrs, will be 40% in next 10 yrs.

Chinese manufacture to RMB is like gold to dollar in old days.

- Joined

- Jul 1, 2024

- Messages

- 4,724

- Likes

- 24,787

I think of all the Indian members here you can give him the most befitting reply . @srev2004Most Chinese debt are Internal debt, if the debt is internal, it's infact kind of seigniorage.

US can print money because of its dollar hegemony make the whole world to pay the bill, RMB also can be somehow over printed, it's because China has strongest manufacture and can export to the whole world.

China actually can borrow the future if the manufacture keep on growing, China manufacture in world share greq from 17% to 30% within last 15 yrs, will be 40% in next 10 yrs.

Chinese manufacture to RMB is like gold to dollar in old days.

Internal debt still represents obligations that need to be repaid or serviced, usually through taxation or inflation. If debt servicing requires more money printing, it can lead to inflationary pressures, reducing the purchasing power of the RMB domestically and potentially eroding economic stability.Most Chinese debt are Internal debt, if the debt is internal, it's infact kind of seigniorage.

US can print money because of its dollar hegemony make the whole world to pay the bill, RMB also can be somehow over printed, it's because China has strongest manufacture and can export to the whole world.

China actually can borrow the future if the manufacture keep on growing, China manufacture in world share greq from 17% to 30% within last 15 yrs, will be 40% in next 10 yrs.

Chinese manufacture to RMB is like gold to dollar in old days.

The US benefits from dollar hegemony due to its status as the world's primary reserve currency, supported by global demand for dollars in international trade, investments, and as a safe haven. China's RMB, while increasingly used in international trade, does not yet enjoy the same level of global acceptance. Overprinting RMB could lead to currency devaluation, loss of investor confidence, and reduced purchasing power for Chinese citizens, particularly for imports, which could be destabilizing.

The global dominance of the US dollar is supported not only by economic power but also by trust in US institutions, legal frameworks, and geopolitical stability, factors that cannot be easily replicated by any other country, including China.

China's manufacturing sector has indeed grown significantly, but assuming that it will continue to grow at the same rate over the next decade is speculative. Challenges such as rising labor costs, trade tensions, technological shifts, and environmental concerns could impact this growth trajectory.

Additionally, heavy reliance on manufacturing for economic growth makes the economy vulnerable to global demand shocks, supply chain disruptions, and shifts towards automation and advanced manufacturing in other countries.

Borrowing against future manufacturing growth assumes that the global economy will continue to rely on China at the same or increasing levels, which may not be the case as other nations diversify their supply chains and manufacturing bases to reduce dependence on China.

Comparing the RMB to gold in the context of the old gold standard is problematic. Gold was universally recognized and held intrinsic value, whereas a fiat currency like the RMB is not backed by a physical commodity but rather by the trust and stability of the issuing government.

The RMB's value is influenced by factors such as government policy, economic performance, and international relations, making it far less stable and predictable than gold historically was.

Moreover, if China were to pursue aggressive monetary expansion (overprinting), it could undermine this trust, leading to depreciation of the RMB and reducing its attractiveness as a global currency.

China's official government debt-to-GDP ratio is approximately 98%, depending on the specific year and measurement methods. This figure primarily represents the central government's debt. However, the broader picture of China's debt includes significant contributions from both the corporate and household sectors. China's corporate sector is heavily indebted, and when this is factored in, the overall debt-to-GDP ratio increases substantially. Additionally, household debt in China has been rising steadily, further contributing to the country's total debt burden.

When you combine government, corporate, and household debt, China's total debt-to-GDP ratio exceeds 280%. This aggregate figure, often cited by analysts and institutions like the Bank for International Settlements (BIS), illustrates the extensive debt load that China's economy carries. Such high levels of debt relative to GDP can be a cause for concern, as they may indicate potential financial instability, especially if servicing this debt becomes challenging.

Inflation and currency stability are other crucial factors to consider. Monitoring China's inflation rate, often tracked by the Consumer Price Index (CPI), provides insights into how overprinting the RMB could lead to inflationary pressures. A rising CPI indicates increasing consumer prices, which can erode the purchasing power of the RMB. Additionally, historical data on the RMB's exchange rate against major currencies, such as the US dollar, reveals how currency valuations fluctuate in response to various factors, including monetary policy, economic conditions, and international sentiment.

China's manufacturing sector, a significant driver of its economic growth, has seen its share of global manufacturing increase in recent years. However, it is essential to analyze recent trends to assess whether this growth is sustainable. Indicators like the Purchasing Managers' Index (PMI), which is a leading measure of manufacturing activity, can signal potential slowdowns. Rising labor costs in China also impact the competitiveness of its manufacturing sector, and data on wage growth, particularly in manufacturing hubs, is relevant in this context.

China's economic growth has been heavily reliant on exports, making export growth rates a critical indicator of its economic health. Key sectors such as electronics, machinery, and textiles are particularly telling. Additionally, China's trade balances with key partners provide further insight into its reliance on global markets. A shrinking trade surplus, for instance, could signal vulnerabilities in the economy. Global trends in supply chain diversification, where other countries move manufacturing out of China, can be observed through data on foreign direct investment (FDI) inflows and outflows.

On the global stage, the RMB's role as a reserve currency is still limited compared to the US dollar. Data from the International Monetary Fund (IMF) on the RMB's share in global foreign exchange reserves sheds light on its acceptance as a global currency. The internationalization of the RMB, including its use in trade settlements and inclusion in the IMF’s Special Drawing Rights (SDR) basket, highlights its growing but still constrained global influence.

Foreign investment trends and political risk indicators also play a role in understanding China's economic stability. Trends in foreign direct investment into China, alongside capital flight data, reflect global confidence in China's economy. Additionally, political risk indexes and reports on governance and legal frameworks can provide insights into how China's policies might impact economic stability and investor confidence.

Finally, historical comparisons between gold-backed currencies and fiat currencies like the RMB can be made using data on currency value stability, inflation, and economic growth under different monetary regimes. Additionally, China's demographic trends, particularly its aging population and shrinking workforce, present challenges for future manufacturing growth, as labor shortages and rising dependency ratios could become significant headwinds.

When you combine government, corporate, and household debt, China's total debt-to-GDP ratio exceeds 280%. This aggregate figure, often cited by analysts and institutions like the Bank for International Settlements (BIS), illustrates the extensive debt load that China's economy carries. Such high levels of debt relative to GDP can be a cause for concern, as they may indicate potential financial instability, especially if servicing this debt becomes challenging.

Inflation and currency stability are other crucial factors to consider. Monitoring China's inflation rate, often tracked by the Consumer Price Index (CPI), provides insights into how overprinting the RMB could lead to inflationary pressures. A rising CPI indicates increasing consumer prices, which can erode the purchasing power of the RMB. Additionally, historical data on the RMB's exchange rate against major currencies, such as the US dollar, reveals how currency valuations fluctuate in response to various factors, including monetary policy, economic conditions, and international sentiment.

China's manufacturing sector, a significant driver of its economic growth, has seen its share of global manufacturing increase in recent years. However, it is essential to analyze recent trends to assess whether this growth is sustainable. Indicators like the Purchasing Managers' Index (PMI), which is a leading measure of manufacturing activity, can signal potential slowdowns. Rising labor costs in China also impact the competitiveness of its manufacturing sector, and data on wage growth, particularly in manufacturing hubs, is relevant in this context.

China's economic growth has been heavily reliant on exports, making export growth rates a critical indicator of its economic health. Key sectors such as electronics, machinery, and textiles are particularly telling. Additionally, China's trade balances with key partners provide further insight into its reliance on global markets. A shrinking trade surplus, for instance, could signal vulnerabilities in the economy. Global trends in supply chain diversification, where other countries move manufacturing out of China, can be observed through data on foreign direct investment (FDI) inflows and outflows.

On the global stage, the RMB's role as a reserve currency is still limited compared to the US dollar. Data from the International Monetary Fund (IMF) on the RMB's share in global foreign exchange reserves sheds light on its acceptance as a global currency. The internationalization of the RMB, including its use in trade settlements and inclusion in the IMF’s Special Drawing Rights (SDR) basket, highlights its growing but still constrained global influence.

Foreign investment trends and political risk indicators also play a role in understanding China's economic stability. Trends in foreign direct investment into China, alongside capital flight data, reflect global confidence in China's economy. Additionally, political risk indexes and reports on governance and legal frameworks can provide insights into how China's policies might impact economic stability and investor confidence.

Finally, historical comparisons between gold-backed currencies and fiat currencies like the RMB can be made using data on currency value stability, inflation, and economic growth under different monetary regimes. Additionally, China's demographic trends, particularly its aging population and shrinking workforce, present challenges for future manufacturing growth, as labor shortages and rising dependency ratios could become significant headwinds.

India presents a different economic landscape compared to China, especially when considering debt levels, currency stability, manufacturing growth, and demographic trends.

**Debt Levels:** Unlike China, India's debt-to-GDP ratio, while significant, is more moderate and has been more carefully managed. The Indian government’s debt-to-GDP ratio hovers around 85-90%, which, while substantial, is lower than China's when considering the broader picture of corporate and household debt. India's corporate sector, though also indebted, does not carry the same level of burden as China's, and household debt in India remains relatively low. This more balanced debt profile reduces the risk of financial instability that can come from overleveraging across multiple sectors.

**Inflation and Currency Stability:** India has managed its inflation levels with increasing effectiveness in recent years, largely due to the Reserve Bank of India's (RBI) focus on inflation targeting. The Consumer Price Index (CPI) in India is carefully monitored, and while inflationary pressures do exist, they have not been driven by excessive money printing. The Indian rupee, while subject to fluctuations, has maintained a relatively stable exchange rate against major currencies. India's careful monetary policies and regulatory frameworks have helped avoid the kind of currency devaluation risks that could arise from aggressive monetary expansion.

**Manufacturing Growth and Competitiveness:** India's manufacturing sector is growing, but the country is in a different phase compared to China. India is rapidly industrializing, with significant investments in infrastructure and manufacturing capabilities through initiatives like "Make in India." Labor costs in India are still relatively low compared to China, which positions India as a competitive alternative for global manufacturing. India's manufacturing output is increasing, and the country is strategically diversifying into sectors like electronics, automobiles, and pharmaceuticals, aiming to increase its share in global manufacturing without the same heavy dependence that China has developed.

**Export Growth and Trade Balance:** India’s economy is less reliant on exports compared to China, with a more balanced growth model that includes a strong service sector. However, India is expanding its export capabilities, particularly in technology and pharmaceuticals, which have seen robust growth. India’s trade balances have been relatively stable, and the country has been actively working to reduce its trade deficit through increased exports and reduced dependency on imports, particularly in critical sectors like defense and electronics.

**Currency and Global Influence:** The Indian rupee is not a global reserve currency like the US dollar, nor is it as internationally recognized as the Chinese RMB. However, this also means that India has not overextended itself in trying to internationalize its currency aggressively. The rupee’s value is primarily influenced by domestic factors, and India has maintained a relatively cautious approach to currency management, avoiding the pitfalls of excessive monetary expansion.

**Demographic Trends and Future Growth:** One of India’s most significant advantages is its demographic profile. Unlike China, which faces the challenge of an aging population, India has a young and growing workforce. This demographic dividend is expected to fuel India’s economic growth in the coming decades. India’s population is projected to surpass China’s, providing a vast labor pool that can support sustained manufacturing and economic growth. Additionally, with a growing middle class, domestic consumption is expected to drive a significant portion of India's future growth, reducing the reliance on external markets.

**Political and Economic Stability:** India has a stable democratic system with a strong legal framework that supports economic growth and investor confidence. Foreign direct investment (FDI) into India has been robust, reflecting global confidence in India's long-term growth potential. India’s regulatory environment, while sometimes complex, offers a degree of transparency and predictability that is appealing to investors. Furthermore, India’s focus on digitalization and technological innovation positions it well for future growth in a global economy increasingly driven by technology.

In summary, while India faces its own set of challenges, it does not have the same level of systemic risks related to debt, overreliance on exports, or demographic headwinds that China does. India’s more balanced approach to growth, its demographic advantages, and its stable political and economic environment provide a strong foundation for sustained growth without the significant risks that come from overextension or overreliance on any single sector or economic strategy.

**Debt Levels:** Unlike China, India's debt-to-GDP ratio, while significant, is more moderate and has been more carefully managed. The Indian government’s debt-to-GDP ratio hovers around 85-90%, which, while substantial, is lower than China's when considering the broader picture of corporate and household debt. India's corporate sector, though also indebted, does not carry the same level of burden as China's, and household debt in India remains relatively low. This more balanced debt profile reduces the risk of financial instability that can come from overleveraging across multiple sectors.

**Inflation and Currency Stability:** India has managed its inflation levels with increasing effectiveness in recent years, largely due to the Reserve Bank of India's (RBI) focus on inflation targeting. The Consumer Price Index (CPI) in India is carefully monitored, and while inflationary pressures do exist, they have not been driven by excessive money printing. The Indian rupee, while subject to fluctuations, has maintained a relatively stable exchange rate against major currencies. India's careful monetary policies and regulatory frameworks have helped avoid the kind of currency devaluation risks that could arise from aggressive monetary expansion.

**Manufacturing Growth and Competitiveness:** India's manufacturing sector is growing, but the country is in a different phase compared to China. India is rapidly industrializing, with significant investments in infrastructure and manufacturing capabilities through initiatives like "Make in India." Labor costs in India are still relatively low compared to China, which positions India as a competitive alternative for global manufacturing. India's manufacturing output is increasing, and the country is strategically diversifying into sectors like electronics, automobiles, and pharmaceuticals, aiming to increase its share in global manufacturing without the same heavy dependence that China has developed.

**Export Growth and Trade Balance:** India’s economy is less reliant on exports compared to China, with a more balanced growth model that includes a strong service sector. However, India is expanding its export capabilities, particularly in technology and pharmaceuticals, which have seen robust growth. India’s trade balances have been relatively stable, and the country has been actively working to reduce its trade deficit through increased exports and reduced dependency on imports, particularly in critical sectors like defense and electronics.

**Currency and Global Influence:** The Indian rupee is not a global reserve currency like the US dollar, nor is it as internationally recognized as the Chinese RMB. However, this also means that India has not overextended itself in trying to internationalize its currency aggressively. The rupee’s value is primarily influenced by domestic factors, and India has maintained a relatively cautious approach to currency management, avoiding the pitfalls of excessive monetary expansion.

**Demographic Trends and Future Growth:** One of India’s most significant advantages is its demographic profile. Unlike China, which faces the challenge of an aging population, India has a young and growing workforce. This demographic dividend is expected to fuel India’s economic growth in the coming decades. India’s population is projected to surpass China’s, providing a vast labor pool that can support sustained manufacturing and economic growth. Additionally, with a growing middle class, domestic consumption is expected to drive a significant portion of India's future growth, reducing the reliance on external markets.

**Political and Economic Stability:** India has a stable democratic system with a strong legal framework that supports economic growth and investor confidence. Foreign direct investment (FDI) into India has been robust, reflecting global confidence in India's long-term growth potential. India’s regulatory environment, while sometimes complex, offers a degree of transparency and predictability that is appealing to investors. Furthermore, India’s focus on digitalization and technological innovation positions it well for future growth in a global economy increasingly driven by technology.

In summary, while India faces its own set of challenges, it does not have the same level of systemic risks related to debt, overreliance on exports, or demographic headwinds that China does. India’s more balanced approach to growth, its demographic advantages, and its stable political and economic environment provide a strong foundation for sustained growth without the significant risks that come from overextension or overreliance on any single sector or economic strategy.

China's growth strategy, characterized by heavy subsidization and deliberate financial losses to gain market dominance, raises significant concerns about its long-term sustainability. While this approach has allowed Chinese companies to capture substantial market share in industries such as steel, solar panels, and telecommunications, the reliance on aggressive pricing and government support can lead to economic inefficiencies. For instance, by selling products at or below cost to outcompete global rivals, Chinese firms often prioritize short-term market share over profitability, potentially creating unsustainable financial practices and overcapacity within these sectors.

Moreover, the strategy of leveraging economies of scale and dominating global supply chains, while effective in the short term, may contribute to long-term vulnerabilities. The extensive use of dumping practices, where products are sold in foreign markets at lower prices than in the domestic market, can undermine international competitors and lead to industry consolidation. However, this aggressive approach also risks provoking trade tensions and retaliatory measures from other countries, as seen in the escalating trade conflicts with the United States and the European Union. These tensions could disrupt global markets and diminish China's ability to sustain its growth.

Ultimately, the heavy reliance on subsidies and state intervention in strategic industries may lead to financial imbalances, such as high levels of corporate debt and economic inefficiencies. As China continues to push its influence through initiatives like the Belt and Road Initiative, the potential for geopolitical resistance grows, further challenging the long-term viability of its growth strategy. While this approach has brought China significant economic power, its sustainability is increasingly questioned, particularly as global powers seek to counterbalance China's influence in the world economy.

Moreover, the strategy of leveraging economies of scale and dominating global supply chains, while effective in the short term, may contribute to long-term vulnerabilities. The extensive use of dumping practices, where products are sold in foreign markets at lower prices than in the domestic market, can undermine international competitors and lead to industry consolidation. However, this aggressive approach also risks provoking trade tensions and retaliatory measures from other countries, as seen in the escalating trade conflicts with the United States and the European Union. These tensions could disrupt global markets and diminish China's ability to sustain its growth.

Ultimately, the heavy reliance on subsidies and state intervention in strategic industries may lead to financial imbalances, such as high levels of corporate debt and economic inefficiencies. As China continues to push its influence through initiatives like the Belt and Road Initiative, the potential for geopolitical resistance grows, further challenging the long-term viability of its growth strategy. While this approach has brought China significant economic power, its sustainability is increasingly questioned, particularly as global powers seek to counterbalance China's influence in the world economy.

India’s approach to economic growth and industrial development has been notably different from China’s, particularly in its more restrained use of subsidies. Instead of relying heavily on direct financial support to specific industries or companies, India has generally focused on creating a more market-driven environment. This strategy emphasizes regulatory reforms, infrastructure development, and investment incentives to stimulate growth rather than artificially propping up sectors through extensive state intervention.

One of the key aspects of India’s approach is its emphasis on attracting foreign direct investment (FDI) and fostering competitive markets. The Indian government has implemented various policies aimed at liberalizing the economy, reducing barriers to entry, and encouraging private sector participation. Rather than subsidizing domestic industries to the same extent as China, India has sought to make its markets more attractive to both domestic and international investors by improving ease of doing business, reforming tax structures, and investing in infrastructure projects like roads, ports, and digital connectivity.

India also focuses on social welfare programs and targeted subsidies for the most vulnerable populations rather than widespread industrial subsidies. For instance, subsidies in India are often directed towards sectors like agriculture, education, and healthcare to support the rural and economically disadvantaged sections of society. These subsidies are intended to promote inclusive growth and reduce poverty, rather than to distort markets in favor of specific industries. This approach aims to balance economic development with social equity, avoiding the economic inefficiencies and trade distortions often associated with broad-based industrial subsidies.

One of the key aspects of India’s approach is its emphasis on attracting foreign direct investment (FDI) and fostering competitive markets. The Indian government has implemented various policies aimed at liberalizing the economy, reducing barriers to entry, and encouraging private sector participation. Rather than subsidizing domestic industries to the same extent as China, India has sought to make its markets more attractive to both domestic and international investors by improving ease of doing business, reforming tax structures, and investing in infrastructure projects like roads, ports, and digital connectivity.

India also focuses on social welfare programs and targeted subsidies for the most vulnerable populations rather than widespread industrial subsidies. For instance, subsidies in India are often directed towards sectors like agriculture, education, and healthcare to support the rural and economically disadvantaged sections of society. These subsidies are intended to promote inclusive growth and reduce poverty, rather than to distort markets in favor of specific industries. This approach aims to balance economic development with social equity, avoiding the economic inefficiencies and trade distortions often associated with broad-based industrial subsidies.

Low priced group ordering of food is the new fad in china

asia.nikkei.com

asia.nikkei.com

China's Meituan delivers double-digit growth with group food orders

Takeout app's algorithms help it offer lower prices to frugal consumers

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)

Latest Replies

-

Operation Sindoor & Aftermath

- IRDefense

-

IAF's Sukhoi Su-30MKI

- E-195

-

Indian Navy Developments & Discussions

- vampyrbladez

-

Chinese Economy Watch

- E-195

-

Indian Air Force: News & Discussions

- silentassassin265

-

Russian Ukrainian War

- Noob_Saibot

Trending Threads