- Joined

- Jun 30, 2024

- Messages

- 3,449

- Likes

- 29,826

So the Upcoming Semiconductor related ecosystem will be in

1. Gujarat. (OSAT)

2. Assam. (OSAT)

3. TamilNadu (Lithography Machines)

4. Odisha (SiC based semi)

What are the other states with Semicon Industry?

1. Maharastra (Tower)

2. Punjab - Mohali (Rumoured SCL Upgradation)

Bro can u list the plants or factories under construction for semiconSo the Upcoming Semiconductor related ecosystem will be in

1. Gujarat. (OSAT)

2. Assam. (OSAT)

3. TamilNadu (Lithography Machines)

4. Odisha (SiC based semi)

What are the other states with Semicon Industry?

1. Maharastra (Tower)

2. Punjab - Mohali (Rumoured SCL Upgradation)

Will try to have one.Bro can u list the plants or factories under construction for semicon

Sir can anyone please explain if GOI is giving 50% cost of setting up semiconductor factory how will they recover the investment (by taxes paid by the products and employees?) . And isn't this like freebes but to corporates. And if they are giving this much money shouldn't they become partner in the company

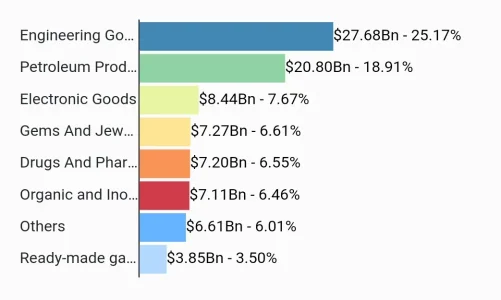

The domestic production of electronic items has increased significantly fromINR 1.80 lakh crore (29.8 Billion USD) in 2013-14 to INR 8.22 lakh crore in 2022-23 (102 BillionUSD) at a Compound Annual Growth Rate (CAGR) of 18.4%, which is further expected to growuptoINR23,95,195 crores (USD 300 Billion) by 2026.Export of electronic goods has also increasedfrom INR 47,557 crore (USD 7.86 Bn) in FY 2013-14 to INR 1,89,934 crore in FY 2022-23 (USD23.5 Bn), exhibiting Compound Annual Growth Rate (CAGR) of 16.7%(as per industryestimates).

Thank you sir for your intellectual insightvery good question..

there are two ways to look at it, one is yours from a tax payer perspective by viewing it as freebies to corporates, which is the typical socialist view.

another way is, viewing it as gormint reinvesting part of tax revenues they got from electronics manufacturing back into electronics supply chain, to increase the number of locally manufactured components, which in turn will increase future gormint revenues as more of the supply chain gets localised.

this is an excerpt from lok sabha reply.

if we subtract total exports from domestic production for 22-23, we get 6.33 lakh crore domestic sales from locally produced electronics. at 18% GST for electronics on domestic sales, gormint gets 1.13 lakh crores of tax revenues per year minimum. and the total incentive package is around 76000 crores for semi con, which is less than what revenues exchequer is receiving per year. if these companies manage to utilise this 76000 crore incentive over five years, government is giving out only 15000 crores per year on average .but because of this incentive, more components are made here, so more jobs, more currency circulation, more tax revenues for gormint.

may not be exact numbers, but to get a rough idea.

https://sansad.in/getFile/loksabhaquestions/annex/1715/AU706.pdf?source=pqals#:~:text=The domestic production of electronic,USD 300 Billion) by 2026.

this is just one angle, others are:

- saving forex outgo

- creating job opportunity

- expanding India's manufacturing landscape

- protecting supply chain from global crisis shocks.

etc..

You need to see the investment in the context of our Electronics manufacturing ecosystem.Sir can anyone please explain if GOI is giving 50% cost of setting up semiconductor factory how will they recover the investment (by taxes paid by the products and employees?) . And isn't this like freebes but to corporates. And if they are giving this much money shouldn't they become partner in the company