gdp (productivity) and income arent the same thing either. though much mmore closley related than gdp and wealth

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Indian Economy (11 Viewers)

- Thread starter haldilal

- Start date

More options

Who Replied?- Joined

- Jun 30, 2024

- Messages

- 3,380

- Likes

- 29,428

Benefits: Increased documentation of newer goods and services produced in a country that is not captured using older base year calculations and accurately assesses the size and scale of economy.Sir can you please explain it's benefits and why it was not done earlier.

Why was it not done earlier: It was done earlier in 2015, but it is done once every 10 years.

- Joined

- Jun 27, 2024

- Messages

- 962

- Likes

- 6,873

Sir can you please explain it's benefits and why it was not done earlier.

The key thing to understand about GDP is that they are estimates, not comprehensive totals based on figures reported by every producer in the country. For most countries, the process begins with a survey to identify how much production is taking place in each industry in a particular year, which is thereafter used as the base year for further GDP calculations.

In subsequent years, statistical services gathers data from a sample of firms in each industry in order to estimate the growth of production in that particular segment of the economy. Those industry-specific growth rates are then multiplied by the industry weights measured in the base year(2011-2012 in this case), and the results are published as the growth of the overall economy since the base year.

We are now in 2024, and 13 years is long enough for an economy to have undergone some significant structural change since the base year. New industries that have emerged since the base year may be overlooked entirely; industries that undergo substantial structural change may be under-reported as well.

So base year revision generally results in an increase of GDP, but how much will it increase is something that we don't know.

- Joined

- Jul 1, 2024

- Messages

- 1,856

- Likes

- 9,977

RBI Policy: MPC Cuts Cash Reserve Ratio By 50 Bps To 4%; Market Turns Positive

RBI cuts CRR to 4%, releasing Rs 1.16 lakh crore liquidity. GDP growth forecast reduced to 6.6% for FY25. Repo rate stays at 6.5%.

RBI Policy: MPC Cuts Cash Reserve Ratio By 50 Bps To 4%; Market Turns Positive

The RBI slashes the Cash Reserve Ratio by 50 bps to 4%, injecting Rs 1.16 lakh crore liquidity into banks, as it revises India’s GDP growth forecast to 6.6% reducing from 7.2%.

- Joined

- Jul 1, 2024

- Messages

- 1,856

- Likes

- 9,977

1] Policy Measures:

Repo rate unchanged at 6.5%

Policy stance unchanged at ‘Neutral’

SDF rate unchanged at 6.25%

MSF rate unchanged at 6.75%

Bank Rate unchanged at 6.75%

MPC members voted by 4:2 majority to maintain status quo

CRR cut by 50 bps to 4%

CRR cut to release ₹1.16 lakh crore into banking system in two tranches

2] GDP Growth Estimates:

FY25 GDP growth estimates cut to 6.6% from 7.2% earlier. Quarterly GDP growth estimates are -

FY25: Cut to 6.6% from 7.2%

Q3FY25: Cut to 6.8% from 7.4%

Q4FY25: Cut to 7.2% from 7.4%

Q1FY26: Cut to 6.9% from 7.3%

Q2FY26: At 7.3%

3] CPI Inflation Forecast

FY25 CPI inflation target raised to 4.8% from 4.5%. Quarterly inflation forecast are -

FY25: Raised to 4.8% from 4.5%

Q3FY25: Raised to 5.7% from 4.8%

Q4FY25: Raised to 4.5% from 4.2%

Q1FY26: Raised to 4.6% from 4.3%

Q2FY26: At 4%

4] Additional Measures. Misc..

Check on website.

Repo rate unchanged at 6.5%

Policy stance unchanged at ‘Neutral’

SDF rate unchanged at 6.25%

MSF rate unchanged at 6.75%

Bank Rate unchanged at 6.75%

MPC members voted by 4:2 majority to maintain status quo

CRR cut by 50 bps to 4%

CRR cut to release ₹1.16 lakh crore into banking system in two tranches

2] GDP Growth Estimates:

FY25 GDP growth estimates cut to 6.6% from 7.2% earlier. Quarterly GDP growth estimates are -

FY25: Cut to 6.6% from 7.2%

Q3FY25: Cut to 6.8% from 7.4%

Q4FY25: Cut to 7.2% from 7.4%

Q1FY26: Cut to 6.9% from 7.3%

Q2FY26: At 7.3%

3] CPI Inflation Forecast

FY25 CPI inflation target raised to 4.8% from 4.5%. Quarterly inflation forecast are -

FY25: Raised to 4.8% from 4.5%

Q3FY25: Raised to 5.7% from 4.8%

Q4FY25: Raised to 4.5% from 4.2%

Q1FY26: Raised to 4.6% from 4.3%

Q2FY26: At 4%

4] Additional Measures. Misc..

Check on website.

- Joined

- Jul 4, 2024

- Messages

- 785

- Likes

- 1,863

Any decrease in home loan ??1] Policy Measures:

Repo rate unchanged at 6.5%

Policy stance unchanged at ‘Neutral’

SDF rate unchanged at 6.25%

MSF rate unchanged at 6.75%

Bank Rate unchanged at 6.75%

MPC members voted by 4:2 majority to maintain status quo

CRR cut by 50 bps to 4%

CRR cut to release ₹1.16 lakh crore into banking system in two tranches

2] GDP Growth Estimates:

FY25 GDP growth estimates cut to 6.6% from 7.2% earlier. Quarterly GDP growth estimates are -

FY25: Cut to 6.6% from 7.2%

Q3FY25: Cut to 6.8% from 7.4%

Q4FY25: Cut to 7.2% from 7.4%

Q1FY26: Cut to 6.9% from 7.3%

Q2FY26: At 7.3%

3] CPI Inflation Forecast

FY25 CPI inflation target raised to 4.8% from 4.5%. Quarterly inflation forecast are -

FY25: Raised to 4.8% from 4.5%

Q3FY25: Raised to 5.7% from 4.8%

Q4FY25: Raised to 4.5% from 4.2%

Q1FY26: Raised to 4.6% from 4.3%

Q2FY26: At 4%

4] Additional Measures. Misc..

Check on website.

- Joined

- Jul 1, 2024

- Messages

- 1,856

- Likes

- 9,977

Any decrease in home loan ??

- Joined

- Jul 1, 2024

- Messages

- 1,971

- Likes

- 11,787

Kanjoos RBI+ kanjoos gormint1] Policy Measures:

Repo rate unchanged at 6.5%

Policy stance unchanged at ‘Neutral’

SDF rate unchanged at 6.25%

MSF rate unchanged at 6.75%

Bank Rate unchanged at 6.75%

MPC members voted by 4:2 majority to maintain status quo

CRR cut by 50 bps to 4%

CRR cut to release ₹1.16 lakh crore into banking system in two tranches

2] GDP Growth Estimates:

FY25 GDP growth estimates cut to 6.6% from 7.2% earlier. Quarterly GDP growth estimates are -

FY25: Cut to 6.6% from 7.2%

Q3FY25: Cut to 6.8% from 7.4%

Q4FY25: Cut to 7.2% from 7.4%

Q1FY26: Cut to 6.9% from 7.3%

Q2FY26: At 7.3%

3] CPI Inflation Forecast

FY25 CPI inflation target raised to 4.8% from 4.5%. Quarterly inflation forecast are -

FY25: Raised to 4.8% from 4.5%

Q3FY25: Raised to 5.7% from 4.8%

Q4FY25: Raised to 4.5% from 4.2%

Q1FY26: Raised to 4.6% from 4.3%

Q2FY26: At 4%

4] Additional Measures. Misc..

Check on website.

Total clownery going on.

- Joined

- Jul 4, 2024

- Messages

- 380

- Likes

- 2,235

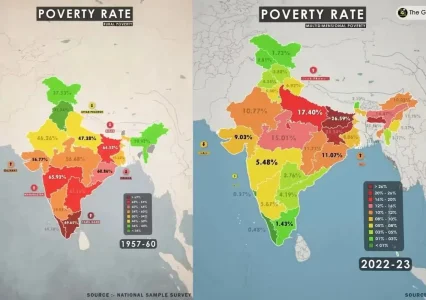

Kerala, Tamil Nadu, Gultis and Maharastra have seen tremendous improvement. Punjab, haryana and himachal were prosperous even back then.

- Joined

- Jul 1, 2024

- Messages

- 4,677

- Likes

- 24,555

View: https://youtu.be/PvNqjrXQJys?si=v7h86hcw17o6QToh

Interesting talking points by Clutterji especially since our economy is just about plodding along since the last couple of years. What're your views ? @ezsasa ; @crazywithmath

- Joined

- Jul 1, 2024

- Messages

- 1,971

- Likes

- 11,787

Interesting talking points by Clutterji especially since our economy is just about plodding along since the last couple of years.

I would not term it 'just about plodding along' tho. Truth be told, almost all the emerging economies would love to 'plod along' with 8%+ real GDP growth, haha.

View: https://youtu.be/PvNqjrXQJys?si=v7h86hcw17o6QToh

Interesting talking points by Clutterji especially

I am going to quote him directly from the piece published on the Print;

First, he refers to that recent incident where some retired babu confused GDP with wealth and corrects him. But then he goes on and says this;

How could a mythology like this, however romantic, find such currency 33 years after the 1991 reforms? This gives us the first trigger: that old, povertarian instincts are back, assailing the hearts and minds of the smartest.

I am sorry but this is plain and simple stupid. A bunch of retarded former babus, dalals (pun intended) and commies masquerading as economists circlejerking does not affect the general population or the gormint one bit.

The second is the steel industry doubling up on lobbying for even more duties on imports, making India’s steel among the most expensive anywhere.

Couptaji shd consider looking up who exactly is itching to export their surplus steel to us, if he hasn't already. Heck, this isn't even an India specific phenomenon rn.

and when the bigger ‘boys’, the automakers, whisper to you—looking left and right to make sure nobody is watching— about the imported containers sitting in our ports forever, awaiting clearance.

Their issue isn’t just the price. About 20 percent of the steel needed by the auto industry is of the kind not yet made in India. The government, however, doesn’t care, having gone full protectionist.

Possibly, the only sensible argument here.

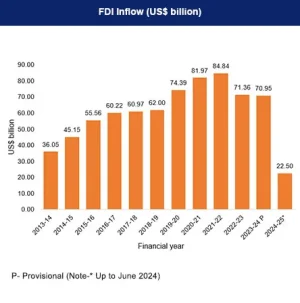

Our FDI more than halved from $56 billion in 2019-20 to $26.8 billion in 2023-24, and

Is he aware of global headwinds? That global FDI shrank by 2% in 2023? It will pick up once Fed loosens their policy - wonder how he will explain it.

Trade is stalled.

Should have looked up this fiscal's trade numbers so far.

Also, global trade declined by 3% in 2023. Indian exports didn't.

The year’s GDP growth has been cut by the RBI to 6.6 per cent.

Irrelevant.

Last edited:

- Joined

- Jul 1, 2024

- Messages

- 2,366

- Likes

- 14,571

View: https://youtu.be/PvNqjrXQJys?si=v7h86hcw17o6QToh

Interesting talking points by Clutterji especially since our economy is just about plodding along since the last couple of years. What're your views ? @ezsasa ; @crazywithmath

There are three perfectly timed triggers for this week’s National Interest. First, the easy virality of a social media post somebody wrote mixing up India’s GDP and the wealth (as determined by market capitalisation) of its billionaires and talking about how it exposes the stark inequalities in our society.

It is possible that the 1991 reform took the energy out of the FFE. As if its cause had been achieved with the philosophical victory. The forum does live on with eminent lawyer and tax expert H.P. Ranina as president. But it’s no longer an intellectual powerhouse that will reach out to people young and old in all parts of the country to counter the relentless return of bad old ideas: import substitution, government-mandated incentives (PLI for example), retrospective taxation, protectionism, the return of the big state, goodbye to privatisation.

Translation :

One of our own lutyens elites who we were grooming to be the guy from the system to "speak truth to power" got caught with his pants down by being ignorant about basic economic theory. agenda ucha rahein hamara, so let me try and confuse the issue like i do always. my chelas will do the rest by creating editorial content and asking loaded questions for next year or so and make sure public forgets what our guy did. while i am at it, might as well transfer albatross around my favourite party's neck like their past economic misdeeds onto current regime.

- Joined

- Jul 1, 2024

- Messages

- 4,677

- Likes

- 24,555

View: https://youtu.be/PvNqjrXQJys?si=v7h86hcw17o6QToh

Interesting talking points by Clutterji especially since our economy is just about plodding along since the last couple of years. What're your views ? @ezsasa ; @crazywithmath

In the event he's made the video private.

- Joined

- Jul 1, 2024

- Messages

- 2,366

- Likes

- 14,571

especially since our economy is just about plodding along since the last couple of years

which input prompted this impression?

- Joined

- Jul 1, 2024

- Messages

- 4,677

- Likes

- 24,555

The low FDI's actually. It's dismal the past 2-3 years.which input prompted this impression?

- Joined

- Jun 30, 2024

- Messages

- 3,380

- Likes

- 29,428

- Joined

- Jun 27, 2024

- Messages

- 962

- Likes

- 6,873

Surat’s garment sector set to grow 20-25% as global brands seek stability away from Bangladesh

Brands are shifting garment sourcing from Bangladesh to Indian manufacturers due to ongoing instability. Surat's textile industry is looking at a growth surge, with inquiries rising for ready-to-wear garments. Other Indian textile hubs like Tamil Nadu, Punjab, and Noida are also expected to...

- Joined

- Jul 5, 2024

- Messages

- 423

- Likes

- 3,289

Latest Replies

-

Indian Culture and society

- Doreamon

-

Indian Navy Developments & Discussions

- vampyrbladez

-

Indian Special Forces

- KumaoniReborn

-

Failed Terrorist Beggar State of Pakistan: Idiotic Musings

- vin pahadi (kumauni)

-

Indian Economy

- vin pahadi (kumauni)

-

Idiotic Musings from the West

- vin pahadi (kumauni)

-

NAL Saras and RTA Programme Thread

- Pundit Pikachu