According to the report, the average cost of imported coal for India rose to over Rs 12,500 per tonne in FY23 from Rs 8,300 in FY22 and Rs 4,300 in FY21, primarily driven by a rise in Indonesian coal prices that constitutes the majority of the imports.

The rise in power demand also led to an increase in power prices in spot power trading exchanges. “Average exchange prices rose from Rs 4.69 per unit in FY22 to Rs 6.06 per unit in FY23. The rise was much more prevalent in summer months with Q1 prices rising from Rs 3.14 per unit in FY22 to Rs 7.86 per unit in FY23,” the report said.

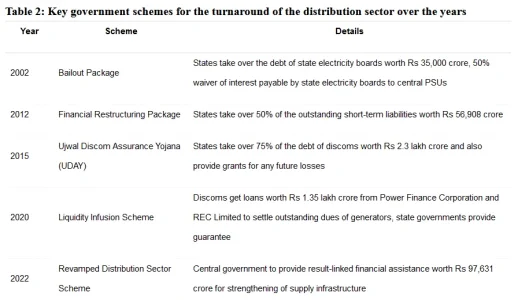

As discoms pushed all buttons to meet the demand, their total debt rose to Rs 70,000 crore for funding their capital expenditure, working capital requirement, and operational losses. According to the report, five states (Andhra Pradesh, Maharashtra, Rajasthan, Tamil Nadu, and Telangana) accounted for over 89 per cent of the debt increase for the nation. Uttar Pradesh was also among the top five contributors for capex, and its discom was the largest recipient of equity infusion of over Rs 6,500 crore.

Atleast one reason we could see here is the rise in coal prices and the demand adding to it ,

I couldn't find state wise data , just same articles giving a summary of overall lose, what I found was a GOI report in 2022 where they say