- Joined

- Jul 4, 2024

- Messages

- 785

- Likes

- 1,865

View: https://x.com/MeghUpdates/status/1871948092834197899

Is this going to happen , looking at current condition ?

View: https://x.com/MeghUpdates/status/1871948092834197899

Is this going to happen , looking at current condition ?

It's dollar getting stronger due to international slowdown and flight to safety.Currency in free fall, unless there is big bump from rebase I don't think so. BTW, I have seen all the BJP IT cell accounts are now following congressi IT cell pattern and using "Big", "Huge", in all their posts.

True, but I am talking about absolute value of GDP as reported in USD.It's dollar getting stronger due to international slowdown and flight to safety.

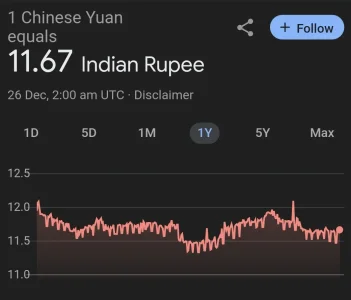

INR became stronger to these currencies.

View attachment 19561View attachment 19562View attachment 19563

But in last one year yen and euro devalued more compared to INR, and Japan and Germany are competitors for 4th and 3rd rank .True, but I am talking about absolute value of GDP as reported in USD.

View: https://x.com/MeghUpdates/status/1871948092834197899

Is this going to happen , looking at current condition ?

India will cross those. I was talking more about hitting 5.5 trillion.But in last one year yen and euro devalued more compared to INR, and Japan and Germany are competitors for 4th and 3rd rank .

Even 5.5 growth + 5.5 inflation - 2% devaluation = 9% will get us across 5.5T by 2028.India will cross those. I was talking more about hitting 5.5 trillion.

But we are devaluing more than 2%. Its been over 3% this year.Even 5.5 growth + 5.5 inflation - 2% devaluation = 9% will get us across 5.5T by 2028.

Nope 2.5.But we are devaluing more than 2%. Its been over 3% this year.

Unpopular opinion- we should let Chinese set up their factories in India, preferably with an Indian partner. Since Trump will impose tariffs on Chinese exports, their manufacturers will also frantically search for other destinations. It is a very small window we have, and we should not let it go. It is very natural if Chinese are used to set up or better our manufacturing base, just like Koreans and Japanese were used in China.

Unpopular opinion- we should let Chinese set up their factories in India, preferably with an Indian partner. Since Trump will impose tariffs on Chinese exports, their manufacturers will also frantically search for other destinations. It is a very small window we have, and we should not let it go. It is very natural if Chinese are used to set up or better our manufacturing base, just like Koreans and Japanese were used in China.

It is worth highlighting that Chinese investments in India have historically been quite underwhelming. India’s official figures show that China’s cumulative foreign direct investment (FDI) from 2000-2020 amounted to a mere US$2.4 billion. If investments from Hong Kong are included, it totalled another US$4.7 billion between 2000-2023.

There is a very healthy section of people in the non left who believe in Chinese investments giving a leverage to China for an economic squeeze on India at an opportune time.why should that be unpopular? if the chinx allowed the Japanese to help mass industrialize them starting in the 80s, just 40 years after being nankinged, there is no reason why there should be any restrictions. Just look up any Japanese company. They set up overseas factories, did JVs and tech transfers in massive numbers starting from the opening up of the economy. The only reason India has restriction is to help support rent seeking leeches who refuse to scale up. Companies like ATL, Haier, Oppo, Midea have all set up medium to large scale factories here in the last few years, whose factory size is easily in the 99th percentile when compared to the ones set up by indian companies.

Arvind S is writing articles after articles urging the RBI to 'let' the currency fall and find its 'natural value' and here you are saying 'currency is in free fall'.Currency in free fall, unless there is big bump from rebase I don't think so. BTW, I have seen all the BJP IT cell accounts are now following congressi IT cell pattern and using "Big", "Huge", in all their posts.

well this year turned out to be true, unless 5.4% growth is your idea of vishwaguru. the worst has yet to come. this sharp fall in capex will show itself in the upcoming quarters.

View attachment 19452

Have they looked into moving up the Value Chain? Last time I saw, we are importing Surgical Grade Steel and likes of that with Dhandomaxxers scraping bottom barrel crumbs.wow grape

Steelmakers may cut down on Capex amid price slump

Steelmakers in India are expected to reduce their capital expenditure plans in 2025 due to declining steel prices, impacted by increased imports from China. This downturn has resulted in reduced profitability and cash flows, affecting expansion efforts as domestic steel consumption grows. Flat...economictimes.indiatimes.com

wow grape

Steelmakers may cut down on Capex amid price slump

Steelmakers in India are expected to reduce their capital expenditure plans in 2025 due to declining steel prices, impacted by increased imports from China. This downturn has resulted in reduced profitability and cash flows, affecting expansion efforts as domestic steel consumption grows. Flat...economictimes.indiatimes.com