- Joined

- Jul 1, 2024

- Messages

- 1,746

- Likes

- 9,171

I dont know why none of these link is displaying preview. Mods please check.

I will have to look up the details but pretty sure a person earning 10 lpa is in the top 2-3%; if not less.

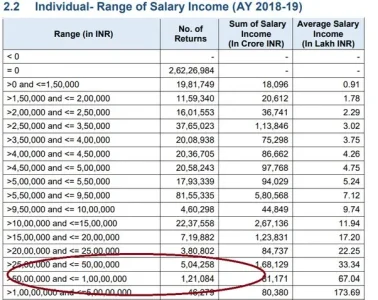

this data is not released often, check if you can search based on the heading in the image below..

i used to pick it up from some finance ministry department website, don't remember it now.

here's from 2020

Hence, only around 1.46 crore individual tax payers are liable to pay income-tax.Further, around 1 crore individuals disclosed income between Rs. 5-10 lakh and only 46 lakh individual tax payers have disclosed income above Rs.10 lakh

View: https://x.com/IncomeTaxIndia/status/1227890943564623872

from 2017-18

View attachment 4100

rest don't even bother, and crybabies don't realise that they are the 1%.Damn .. So the people who actually pay tax(and not just file) is close to 1 % ..

So our rona dhona looks to the rest looks like 1%ers complaining .

this data is not released often, check if you can search based on the heading in the image below..

i used to pick it up from some finance ministry department website, don't remember it now.

here's from 2020

Hence, only around 1.46 crore individual tax payers are liable to pay income-tax.Further, around 1 crore individuals disclosed income between Rs. 5-10 lakh and only 46 lakh individual tax payers have disclosed income above Rs.10 lakh

View: https://x.com/IncomeTaxIndia/status/1227890943564623872

from 2017-18

View attachment 4100

Damn .. So the people who actually pay tax(and not just file) is close to 1 % ..

So our rona dhona looks to the rest looks like 1%ers complaining .

The issue is that folks on this forum are either 1%ers or in a family who's primary provider is a 1 %er . Hence the political sloganeering .. I am also in this group and I am personally disappointed but it is what it is.I have gone through ten pages of this thread. Very few seem to be discussing the budget, rather there is quite blatant political slogonnering. Nonetheless, there are many many positives here

1. Official launch of ANRF. Critical development. We might just have a NSF/DFG of our own here. Will surely boost R&D. Also, a fund of 1K cr for space startups.

2.) Policy and financial support for the development and production of small modular reactors. Private sector allowed into the nuclear scene. Ground breaking news.

3.) Focus on youth upskilling via ITI. $23 billion allocated over 5(?) years.

4.) Finally the govt has realized ome of the most optimal ways of boosting farm incomes. That is by boosting productivity while lowering costs. This done through introducing newer seeds, better farming techniques. Serious focus being put on innovating in agriculture.

Many more good things have been announced. Please focus on them and expand upon the above.

Been lurking for a while so first post. Let's see who can recognize this film.

Been lurking for a while so first post. Let's see who can recognize this film.

Sir they are trying to upskill since 2015, and what's the result ? What happened to Skill India programme ? Rebranding things doesn't bring any change on ground itself.The issue is that folks on this forum are either 1%ers or in a family who's primary provider is a 1 %er . Hence the political sloganeering .. I am also in this group and I am personally disappointed but it is what it is.

However if I put myself in the govmints shoes this budget is absolutely logical . The point 3 is the most critical. We have an unprecedented buildout of factories with the only limiting factor being the absolute ASS tier of skilled labour available in this country.

Some news that wasn't discussed much here:

Abolition of the Angel tax: Less bureaucracy for startups. Founders have been demanding this for many years.

India scraps 'angel tax' in boost for startups | TechCrunch

India's federal government has removed the so-called angel tax for all classes of investors, delivering a major victory to the country's startup ecosystem India has axed the so-called "angel tax" in a major victory to the country's startup ecosystem.techcrunch.com

Incentives to boost MRO activities in aviation, shipping sectors. (MRO is a job heavy sector)

Govt announces incentives to boost MRO activities in aviation, shipping sectors - ET TravelWorld

Budget 2024: "To promote domestic aviation and boat & ship MRO, I propose to extend the period for export of goods imported for repairs from six months to one year. In the same vein, I propose to extend the time-limit for re-import of goods for repairs under warranty from three to five years,"...travel.economictimes.indiatimes.com

1000Cr venture capital fund to spur the growth of the country’s space economy.

Budget 2024–25 offers giant leap for India’s space economy with Rs 1,000 crore venture capital fund

India’s burgeoning space economy will get a significant boost with the establishment of a Rs 1,000 crore venture capital fund, which is expected to propel its gwww.downtoearth.org.in

Sir they are trying to upskill since 2015, and what's the result ? What happened to Skill India programme ? Rebranding things doesn't bring any change on ground itself.

I dont know why none of these link is displaying preview. Mods please check.

Probably this is happening because the website wants the links to be seen on its app. Occasionally the error occurs when metadata is too large to fetch. Sometimes content is age-restricted so and so forth.Could not fetch metadata from URL with error: Response returned a non-successful status code: 403

I had my fair share of unfounded criticism of this budget. In hindsight this budget is not even half bad we are claiming it to be.

We have had an expectation from Govt to decrease the taxes on income every time. If that would happen, then we will end with no budget at all

The focus of govt is to force the corporate sector which has got taxes reduction in recent years but is not willing to create more jobs and pass on benefit to Economy.

Moreover, a ton of Indians over twitter suddenly realised that they are middle class!this will happen every year, after budget.

surprising bit is, for a bunch of enthusiasts who are into national security, most of loud ones are unable to or unwilling to connect that economic security is also part of national security. both to fight wars and to prevent wars, a country needs economic security and industrial power.

BJP govts past and present, one thing they always do is either build new institutions or build state capacity. to understand what they are doing, one has to spend time understanding multiple budget documents in sequence. but who has to time and interest to do all this, especially among working class.

at national level discourse, there are less than 10 experts who can connect the dots and explain it in a way the public can understand. so most of the discourse is marred by electoral politics. was watching budget special on TV, India today's rahul kanwal was going on about germany and UK apprenticeship programmes, our corporate wallahs were trying to explain to him that their system is paper based, ours is backed by digital infra, he was not able to grasp.

i suppose our education system and discourse does not inculcate the idea of being a stakeholder , rather a customer to govt.

"manager to bulao, yeh fingerbowl mein paani itna garam kyun hai".

If median household income is low, it shows how pathetic the govt has been in its administrative and fiscal management.Quick question,

What is the median household income in India?

If anything, almost all the govts have been quite generous when it comes to income taxes.

This is thread on Union Budget, discuss about that and dont derail the discussion by talking about what BJP did or not!If median household income is low, it shows how pathetic the govt has been in its administrative and fiscal management.

The middle class has become middle class by their own merit and without any assistance from Govt or rather despite severe hindrances by the Govt if one is from general Category.

BJP govt has been worst for the middle class forever. But this one especially so. This one actually is running in such a way as if the middle class doesn't have a right to exist.

They are literally causing inflation by giving away money for free and then milking the middle class - not only earnings but also savings.

The rich gets tax breaks in businesses, the poor gets SOPs and Midlle class gets middle finger.

That's why the upper middle class people are leaving and taking aways skillset and money with them.

1. The median household income is low because the economy was opened up in 1991 only. When much of the world was done reforming their domestic economic setups we were busy playing 'socialism'.If median household income is low, it shows how pathetic the govt has been in its administrative and fiscal management.

The middle class has become middle class by their own merit and without any assistance from Govt or rather despite severe hindrances by the Govt if one is from general Category.

BJP govt has been worst for the middle class forever. But this one especially so. This one actually is running in such a way as if the middle class doesn't have a right to exist.

They are literally causing inflation by giving away money for free and then milking the middle class - not only earnings but also savings.

The rich gets tax breaks in businesses, the poor gets SOPs and Midlle class gets middle finger.

That's why the upper middle class people are leaving and taking aways skillset and money with them.