- Joined

- Jul 6, 2024

- Messages

- 2,044

- Likes

- 6,039

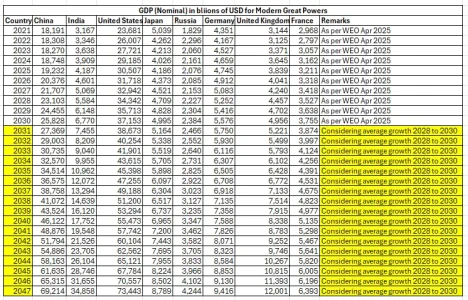

This, US economy is highly inflated due to stock market, land sector and currency manipulation.Now half the US economic numbers to get real economically relevant numbers in terms of economic power.

Because the 'deadweight' in terms of exerting economic power is your property sector . Because land value doesnt contribute an iota in terms of economic influence over others.

Chinese economic growth is 'stagnated' currently because Chinese property market is stagnant/contracting.

The two main driver of US economic wealth addition is US property sector and stock markets.

So the US going from 25 trillion to 30 trillion in the last 4-5 years means very little in terms of actual economic gap with China - the only economic metrics that matter in terms of economic power struggle, is your non real estate sectors - aka agriculture, manufacturing and certain types of services.

In THAT, the gap is much closer and China is gaining ground, which is why in economic power struggle terms, China is the one that is less affected than USA is in this tariff wars.

US gov. Can't really use the this sector for its budget.

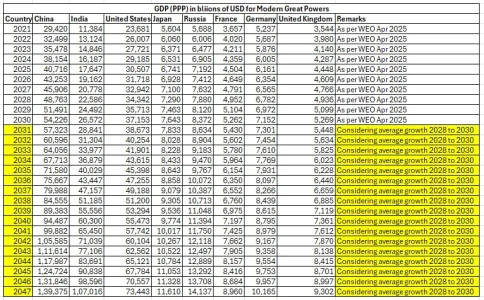

In actual economic output, China has surpassed US, especially if you apply "bang for buck" factor.

Economic Quality of life or US citizens is still in decline even with economy increasing.

And While slow growth in recent years, but economic quality of life is still increased in china.

Current US economy is highly inflated.

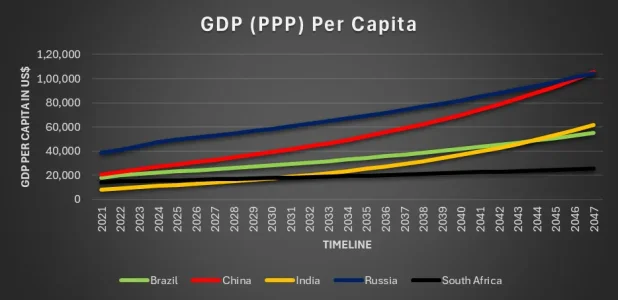

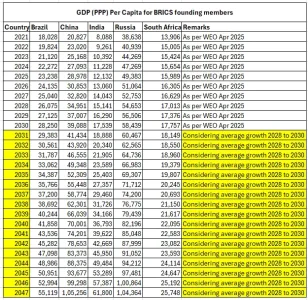

While chinese economy is somewhat inflated in dollar terms, but using Purchasing power parity, chinese economy is still overall undervalued.