You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Indian Economy (11 Viewers)

- Thread starter haldilal

- Start date

More options

Who Replied?- Joined

- Jun 27, 2024

- Messages

- 245

- Likes

- 1,026

Bumper Apple crop! India’s iPhone exports pass Rs 1 lk cr

https://m.economictimes.com/news/ec...pass-rs-1-lk-cr/amp_articleshow/117181077.cms

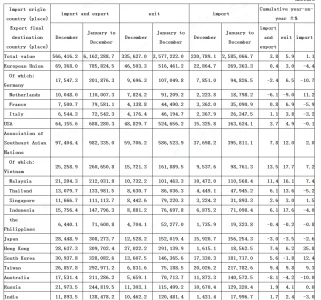

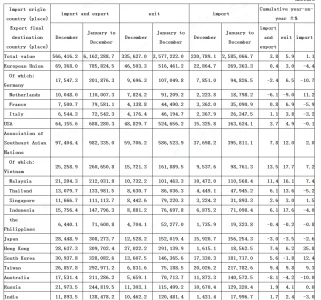

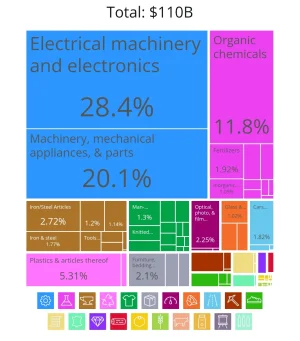

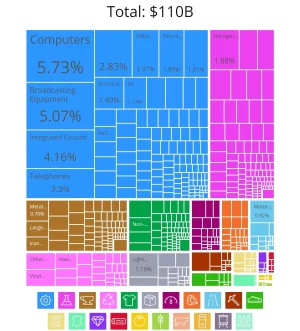

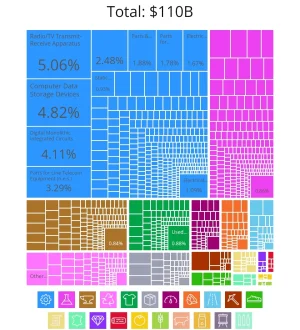

~$102B deficit with China in the last calendar year

BTW, less export growth to India ~2.4%, as compared to ASEAN countries.

Who all are majorly responsible for Chinese trade surplus?

1. US- $361B

2. Hong Kong- $272.5B

3. EU- $247B

-Netherlands- $72.4B

4. India- $102.5B

5. Vietnam- $63B

6. Singapore- $48B

7. Thailand- $39B

8. Philippines- $33B

BTW, less export growth to India ~2.4%, as compared to ASEAN countries.

Who all are majorly responsible for Chinese trade surplus?

1. US- $361B

2. Hong Kong- $272.5B

3. EU- $247B

-Netherlands- $72.4B

4. India- $102.5B

5. Vietnam- $63B

6. Singapore- $48B

7. Thailand- $39B

8. Philippines- $33B

QE is not going to happen?Not gonna happen until another black swan event. We are living in unprecedented times amidst huge uncertainty.

- The FED’ preferred metric PCE is back on the rise.

- The Jobs report is still coming in strong questioning the need for more rate cuts.

- The markets earlier priced in 5 rate cuts this year. Now the forecast is a max of 2 cuts with some banks (BofA) even ruling out.

- They foolishly started with a 50bps cut (instead of 25) and the stock markets had a euphoric run since then with a lot of hope. The reasoning they gave was “jobs have slowed and we are heading to a 2% inflation”

Meanwhile,

- The FED pivot is as good as dead.

The market is fighting the FED as bond yields still surging despite the rate cuts resulting in huge dollar demand.

I think a 6% on 10Y will be the panic button.

Housing market is already going down as a result.

- Stocks and Crypto going up like no tomorrow.

- Gold is being bought like we are in a crisis while Dollar and 10Y is rallying. When was the last time this happened? Probably never.

- All this while inflation is back on the rise far from the 2% goal.

Something has to give in eventually.

And in China, the situation is even worse. The stocks is in a multi year bear market while the 10Y continues to crash further.

If you are a Chinese investor, where will you put your money?

So what does this mean for India?

2025 is probably going to be a period of huge volatility both in the markets and geopolitics.

So we just gotta ride it out and stop worrying about Rupee ‘crashing’.

India is in a far better position that most other major economies IMO.

View attachment 21643

I dunno man im prolly going to start dollar cost averaging into 10y bonds if it touches 5%

- Joined

- Jul 1, 2024

- Messages

- 1,703

- Likes

- 6,456

~$102B deficit with China in the last calendar year

View attachment 21726

BTW, less export growth to India ~2.4%, as compared to ASEAN countries.

Who all are majorly responsible for Chinese trade surplus?

1. US- $361B

2. Hong Kong- $272.5B

3. EU- $247B

-Netherlands- $72.4B

4. India- $102.5B

5. Vietnam- $63B

6. Singapore- $48B

7. Thailand- $39B

8. Philippines- $33B

How can we reduce the surplus with China? It needs to go down to zero at all possible speed.

A drastic reduction is not possibleHow can we reduce the surplus with China? It needs to go down to zero at all possible speed.

We can incentivise Chinese factories for the items we import (Chinese will not allow), we can import from elsewhere (our production cost will increase), we can formulate industrial policy a la PLI (possible, but may not be politically attractive)

- Joined

- Jul 1, 2024

- Messages

- 4,793

- Likes

- 25,168

SAIL, John Cockerill to invest around ₹6,000 crore in building downstream steel plant

SAIL and John Cockerill India will jointly invest ₹6,000 crore to establish a downstream plant for cold-rolled electrical steel types, utilizing SAIL's hot-rolled coils. The plant, anticipated by 2027-2029, aims to produce 1.5 million tonnes per annum and promote green steel innovations under...

The bad news is we're still only mfg 50,000 tons of the 400,000 tons of Cold-rolled grain-oriented (CRGO) sheets which means the rest are imported.

Worse news is even after being the 2nd largest steel mfg in the world we're still dependant of technology from outside be it China or the west which in this case is John Cockerill.

Tells you how innovative our MODERN steel industry is after being in it for more than a century. Now compare that to the Chinese who became the No 1 steel producer in ~ 3 decades & also developed most steel mfg technologies in house after absorbing them from the west one way or another & are now competing with them .

Let me depress you further by informing you that Wootz steel later also world famous as Damascus steel was invented in India

Ah, the classic “India is doing just fine, you’re all just whining” argument, now backed by the groundbreaking claim that anyone earning ₹20-50 LPA isn’t middle class. Bravo. Perhaps the definition of middle class has ascended to a higher plane of existence—one where owning a car, a home, and sending your kids to decent schools without collapsing under EMIs is considered indulgence. But let’s get to the facts, shall we?

Two-wheeler sales—a key indicator of middle-class discretionary spending—are still struggling to touch 2016 levels in 2024. Yes, in a country where two-wheelers are a stepping stone for economic mobility, that market has stagnated for nearly a decade. Meanwhile, entry-level car sales are practically on life support, with the average selling price of vehicles doubling in five years. This isn’t just inflation; it’s a sign that the lower and middle-middle classes are being priced out of upward mobility. But hey, let's pretend they've "benefitted immensely."

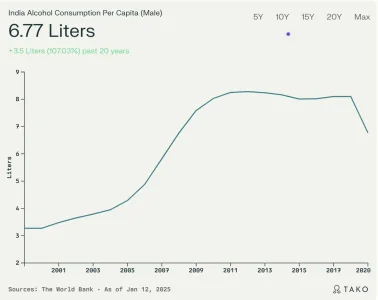

View attachment 21641

And let’s talk inflation—the elephant in the room that your optimism conveniently ignores. Real inflation for urban middle-class households has averaged well over 15% annually this decade, far outpacing the sanitized CPI figures the government loves to tout - rent, basic appliances-education expenses-travel-discretionary spending items. What ₹100 bought in 2014 now buys about ₹35 in 2024, but direct tax brackets haven’t been adjusted in a decade. Add indirect taxes to the mix ----oh what the hell nobody cares until the very floor falls out of India's growth story.

Now, for the pièce de résistance: the 20-50 LPA bracket. You mockingly claim they’re not middle class because they’re in the top 5%, but by every practical measure—owning a house, affording quality education, planning for retirement—they’re barely scraping by in urban centers - developed country expenses at Indian incomes and wealth - Sure sure - upper class - probably the country needs a primer on what middle class and upper classes mean from a fundamentals standpoint - and no - living in a rented home because afforable homes are 10-20x your annual income isnt by anyone's definition - upper class. This is the same group that props up much of India’s private consumption. The government’s tax revenue maximization strategy might make for short-term growth headlines, but it’s gutting the very segment that drives sustainable economic expansion.

But sure, let’s blame “popcorn tax drama” and focus on city cleanliness as the magic wand for economic prosperity. After all, it’s easier to distract with shiny streets than to address why wealth accumulation and upward mobility for the real middle class have stalled. Facts are stubborn things, and reality will find ways to intercept perceptions - oh who cares - certainly not BJP - definitely not Congress.

Its called being delusional.

Raw data is right in front of us and people want to ignore it anyways.

View: https://x.com/sushantsin/status/1876484438822965599?s=46

View: https://x.com/datafactin/status/1876119885610365220?s=46

Prices are being increased to make up for shortfall and all that does is increase the gap even more.

- Joined

- Jul 1, 2024

- Messages

- 2,044

- Likes

- 12,235

JSW acquired some company to start production of crgo sheets, no?

SAIL, John Cockerill to invest around ₹6,000 crore in building downstream steel plant

SAIL and John Cockerill India will jointly invest ₹6,000 crore to establish a downstream plant for cold-rolled electrical steel types, utilizing SAIL's hot-rolled coils. The plant, anticipated by 2027-2029, aims to produce 1.5 million tonnes per annum and promote green steel innovations under...m.economictimes.com

The good news..

The bad news is we're still only mfg 50,000 tons of the 400,000 tons of Cold-rolled grain-oriented (CRGO) sheets which means the rest are imported.

Worse news is even after being the 2nd largest steel mfg in the world we're still dependant of technology from outside be it China or the west which in this case is John Cockerill.

Tells you how innovative our MODERN steel industry is after being in it for more than a century. Now compare that to the Chinese who became the No 1 steel producer in ~ 3 decades & also developed most steel mfg technologies in house after absorbing them from the west one way or another & are now competing with them .

Let me depress you further by informing you that Wootz steel later also world famous as Damascus steel was invented in India

- Joined

- Jul 7, 2024

- Messages

- 279

- Likes

- 2,156

- Joined

- Jul 1, 2024

- Messages

- 2,044

- Likes

- 12,235

I am pretty sure Indians can make excellent bags at this price, but when greed takes over, and there's zero oversight from the government... This is the natural outcome

View: https://x.com/MhaskarChief/status/1879028378705310148?t=eSjwCTq_SBvTI-xVoUGLUw&s=19

View: https://x.com/MhaskarChief/status/1879028378705310148?t=eSjwCTq_SBvTI-xVoUGLUw&s=19

- Joined

- Jul 6, 2024

- Messages

- 1,125

- Likes

- 4,372

If gormint really is gonna give some tax relief in Upcoming budget, how much will be do you think,

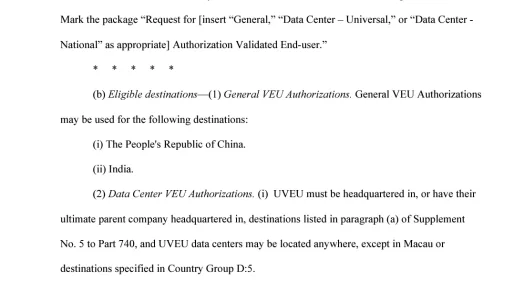

Forget Nilekani, WHat Govt must do is revisit data localization laws and withdraw any concessions given to Amerikis. They are training using our data in their centers citing globalization while deny data centers citing security... If Govt uses two grey cells .. this is the time to strengthen data localization laws.Nandan Nilekani may finally change his mind on LLMs after reading this

So much for being "major defense partner", "strategic partnership" etc etc that is placed in the same category as "enemy".

View attachment 21879

- Joined

- Jul 1, 2024

- Messages

- 2,430

- Likes

- 14,936

the guy you were debating with, didn't believe what you were saying.Forget Nilekani, WHat Govt must do is revisit data localization laws and withdraw any concessions given to Amerikis. They are training using our data in their centers citing globalization while deny data centers citing security... If Govt uses two grey cells .. this is the time to strengthen data localization laws.

Thanks to @ezsasa I am reposting what ezsasa posted. The reason why US should not be trusted

View: https://x.com/WallStreetApes/status/1868138972200739148?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1868138972200739148%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=

Nandan Nilekani may finally change his mind on LLMs after reading this

So much for being "major defense partner", "strategic partnership" etc etc that is placed in the same category as "enemy".

View attachment 21879

Can you explain this for a layman?? What are VEU authorizations?

- Joined

- Jul 1, 2024

- Messages

- 2,430

- Likes

- 14,936

Valid end User authorisation.Can you explain this for a layman?? What are VEU authorizations?

murican commerce ministry has a list of countries that are grouped together.

https://www.bis.doc.gov/index.php/d...lement-no-1-to-part-740-country-groups-1/file

India is on approved list, China is on denial list.

if i am reading this document correctly, in case of AI data centres murican gormint is clubbing India and china together into one category, where an murican company has to get an additional export licence which does not apply to other countries in approved country grouping.

- Joined

- Jul 1, 2024

- Messages

- 1,896

- Likes

- 10,219

I am pretty sure Indians can make excellent bags at this price, but when greed takes over, and there's zero oversight from the government... This is the natural outcome

View: https://x.com/MhaskarChief/status/1879028378705310148?t=eSjwCTq_SBvTI-xVoUGLUw&s=19

White labeling should be punished severely with fines.

Recently in YouTube lava phones had made in India battery by an Indian company stickers.

Guy removed the top layer. There comes the truth bomb. Manufactured in China by ching Chong Jun boon company.

Entire Babus were taken for the ride by these new companies

- Joined

- Jul 4, 2024

- Messages

- 796

- Likes

- 1,872

what does this meant to India ?Valid end User authorisation.

murican commerce ministry has a list of countries that are grouped together.

https://www.bis.doc.gov/index.php/d...lement-no-1-to-part-740-country-groups-1/file

India is on approved list, China is on denial list.

if i am reading this document correctly, in case of AI data centres murican gormint is clubbing India and china together into one category, where an murican company has to get an additional export licence which does not apply to other countries in approved country grouping.

Latest Replies

-

DRDO & PSUs

- snakeeyes07

-

Indo EU Relations

- shade2

-

Operation Sindoor & Aftermath

- Nishaanbaaz

-

Indian Special Forces

- COLDHEARTED AVIATOR

-

Op Sindoor: Memes and Psy-Ops Corner

- FalconSlayers

-

Highways and expressways

- infrabug

-

Indian Railways

- infrabug