Ah, the classic “India is doing just fine, you’re all just whining” argument, now backed by the groundbreaking claim that anyone earning ₹20-50 LPA isn’t middle class. Bravo. Perhaps the definition of middle class has ascended to a higher plane of existence—one where owning a car, a home, and sending your kids to decent schools without collapsing under EMIs is considered indulgence. But let’s get to the facts, shall we?

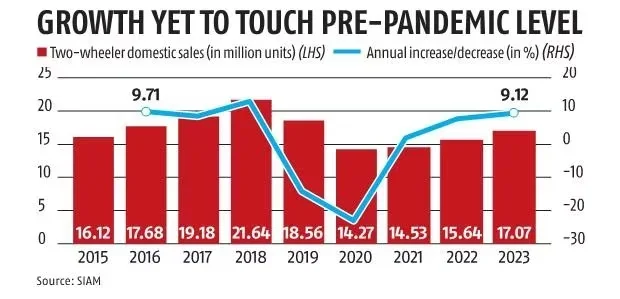

Two-wheeler sales—a key indicator of middle-class discretionary spending—are still struggling to touch 2016 levels in 2024. Yes, in a country where two-wheelers are a stepping stone for economic mobility, that market has stagnated for nearly a decade. Meanwhile, entry-level car sales are practically on life support, with the average selling price of vehicles doubling in five years. This isn’t just inflation; it’s a sign that the lower and middle-middle classes are being priced out of upward mobility. But hey, let's pretend they've "benefitted immensely."

View attachment 21641

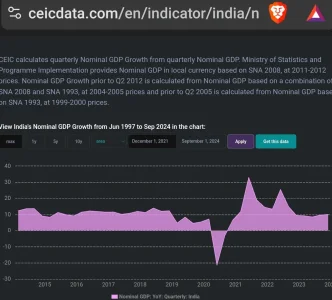

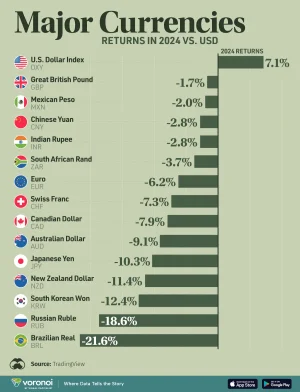

And let’s talk inflation—the elephant in the room that your optimism conveniently ignores. Real inflation for urban middle-class households has averaged well over 15% annually this decade, far outpacing the sanitized CPI figures the government loves to tout - rent, basic appliances-education expenses-travel-discretionary spending items. What ₹100 bought in 2014 now buys about ₹35 in 2024, but direct tax brackets haven’t been adjusted in a decade. Add indirect taxes to the mix ----oh what the hell nobody cares until the very floor falls out of India's growth story.

Now, for the pièce de résistance: the 20-50 LPA bracket. You mockingly claim they’re not middle class because they’re in the top 5%, but by every practical measure—owning a house, affording quality education, planning for retirement—they’re barely scraping by in urban centers - developed country expenses at Indian incomes and wealth - Sure sure - upper class - probably the country needs a primer on what middle class and upper classes mean from a fundamentals standpoint - and no - living in a rented home because afforable homes are 10-20x your annual income isnt by anyone's definition - upper class. This is the same group that props up much of India’s private consumption. The government’s tax revenue maximization strategy might make for short-term growth headlines, but it’s gutting the very segment that drives sustainable economic expansion.

But sure, let’s blame “popcorn tax drama” and focus on city cleanliness as the magic wand for economic prosperity. After all, it’s easier to distract with shiny streets than to address why wealth accumulation and upward mobility for the real middle class have stalled. Facts are stubborn things, and reality will find ways to intercept perceptions - oh who cares - certainly not BJP - definitely not Congress.

public has a short memory and there was no SM then for public to obsess about unless something is reported in the news. this is why RTI activists used to be a big deal.

public has a short memory and there was no SM then for public to obsess about unless something is reported in the news. this is why RTI activists used to be a big deal.