You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Budget 2025

- Thread starter SKC

- Start date

More options

Who Replied?- Joined

- Jan 5, 2025

- Messages

- 153

- Likes

- 693

All

All right you are correct as per speech by fm.Till 12.75, new SD is 75K

- Joined

- Jul 1, 2024

- Messages

- 769

- Likes

- 3,030

Can someone explain, why "no tax till 12lakh" if we still have up to 10% in the tax slab!!

Can someone explain, why "no tax till 12lakh" if we still have up to 10% in the tax slab!!

Your Case: 12 LPA Salary

- If You Are Salaried:

Since you are earning 12 lakhs per annum and the tax-free limit for salaried individuals is 12.75 lakhs, your entire salary falls below the threshold. Result: No income tax. - If You Are Non-Salaried:

For non-salaried individuals, the tax-free limit is 12 lakhs. Since your salary is exactly 12 lakhs, you again fall at the top end of the tax-free range. Result: No income tax.

Conclusion

Regardless of whether you are salaried or not, with a 12 LPA income, you will not pay any income tax under the new Budget 2025 scheme.Note: This explanation assumes that there are no additional sources of income or other factors (like specific deductions or surcharges) that might alter your taxable income.

this is the closest explanation i could get

- Joined

- Jun 27, 2024

- Messages

- 2,905

- Likes

- 10,295

Till 12.75L you will get a rebate and no tax to be paid.Your Case: 12 LPA Salary

- If You Are Salaried:

Since you are earning 12 lakhs per annum and the tax-free limit for salaried individuals is 12.75 lakhs, your entire salary falls below the threshold. Result: No income tax.- If You Are Non-Salaried:

For non-salaried individuals, the tax-free limit is 12 lakhs. Since your salary is exactly 12 lakhs, you again fall at the top end of the tax-free range. Result: No income tax.Conclusion

Regardless of whether you are salaried or not, with a 12 LPA income, you will not pay any income tax under the new Budget 2025 scheme.

Note: This explanation assumes that there are no additional sources of income or other factors (like specific deductions or surcharges) that might alter your taxable income.

this is the closest explanation i could get

The moment you cross that you will be charged of tax in the slabs

4-8L@5% and 8-12L@10% and no rebate is applicable.

This is as per my understanding !!

for those under new tax regime, its a flat "upto 12lacs no tax", but for those opting for old tax regime the tax slab table shown in the tweet still holds true?

- Joined

- Jun 27, 2024

- Messages

- 2,905

- Likes

- 10,295

Effectively If you earn till 24 lakh, you pay only 12% tax. A huge boost in consumption is expected !!for those under new tax regime, its a flat "upto 12lacs no tax", but for those opting for old tax regime the tax slab table shown in the tweet still holds true?

- Joined

- Jul 4, 2024

- Messages

- 690

- Likes

- 1,623

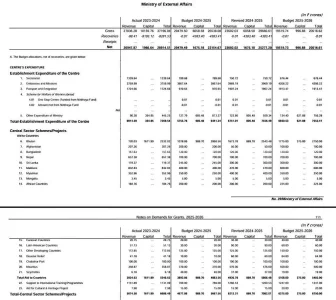

Wat about defence, space, nuclear and research budget??

- Joined

- Jun 30, 2024

- Messages

- 1,672

- Likes

- 21,537

6.8 lakh cr to defense, 18lakh cr capital outlay- a sharp increase in defense pensions, isro around 13k cr.Wat about defence, space, nuclear and research budget??

- Joined

- Jun 30, 2024

- Messages

- 601

- Likes

- 3,205

Indian defence allocation for 2025-2026: ₹6,81,210.27 crore

- Joined

- Jun 30, 2024

- Messages

- 601

- Likes

- 3,205

- Joined

- Jul 1, 2024

- Messages

- 2,076

- Likes

- 12,593

Defence total - 681210 Cr

revenue - 311732 Cr

capital - 180000 Cr

current fiscal for reference

in the current fiscal, capital spending is estimated to be about 1.59 lakh cr. so 1.72 lakh cr could not be utilised. another two months are there in current fiscal, not sure how this calculation works. we'll have to wait and see.

revenue - 311732 Cr

capital - 180000 Cr

current fiscal for reference

in the current fiscal, capital spending is estimated to be about 1.59 lakh cr. so 1.72 lakh cr could not be utilised. another two months are there in current fiscal, not sure how this calculation works. we'll have to wait and see.

Last edited:

Latest Replies

-

Indo US Relations

- LastMythin

-

Operation Sindoor and Aftermath

- Captscooby

-

DRDO and PSUs

- bakofbakchod

-

Indian Small Arms and Weapons

- KAB7777

-

Op Sindoor: Memes and Psy-Ops Corner

- dr.defence

-

Indian Private Defence Sector

- KAB7777

-

LCA TEJAS MK-I & MK-IA: News and Discussion

- vampyrbladez