India as a Manufacturing and Export Powerhouse

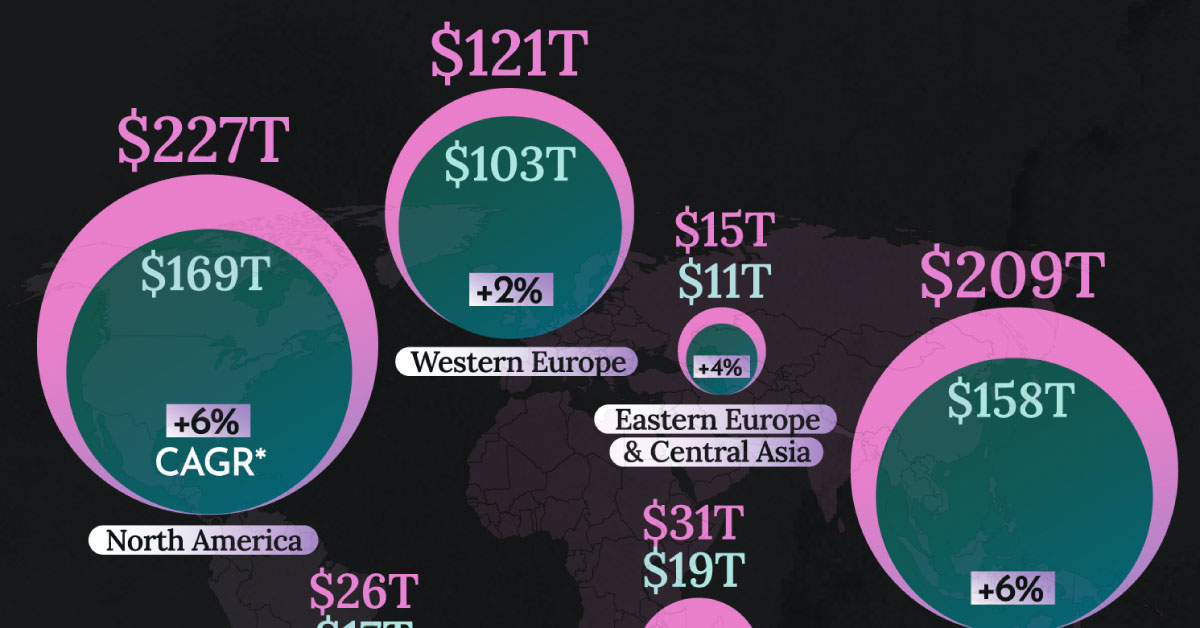

U.S. businesses are being urged to diversify their supply chains away from China, a nation whose growing economic power has fueled a more assertive stance, threatening U.S. interests in the Pacific. However, this shift is now driven by more than just geopolitical concerns—it’s also about the bottom line.

Why is this happening, you might ask?

The reasons mirror those that once made China the go-to destination for manufacturing: cost advantages. Over the past two decades, labor and other costs in China have surged, making it less attractive for American companies accustomed to lower prices. As a result, these companies are now exploring opportunities in emerging economies like India, Vietnam, and Thailand. These countries are not only equipped with robust infrastructure, trained labor forces, and legal frameworks aligned with Western standards, but they also have governments eager to ease the costs of business relocation. What they need most is foreign direct investment (FDI) and technology transfers. Once those elements are in place, a significant portion of Chinese manufacturing could shift to these regions.

Consider the electronics industry: a substantial portion of it has already moved to Vietnam, turning the country into a burgeoning electronics manufacturing hub. In the textile and garment sector, Bangladesh has emerged as a leader. India, with its rapidly developing infrastructure, is poised to outpace both in electronics and textiles, especially once its semiconductor fabrication plants are operational in the next two years. India is already the second-largest exporter of cell phones, with efforts underway to reduce its dependency on imported components, a challenge expected to be addressed within the next three years.

Thailand, too, has made significant economic strides, earning recognition from the World Bank. Its services and electronics export sectors have advanced rapidly, making it a prime destination for Western importers of goods and services.

India’s potential to attract Western businesses is particularly strong, not just because of its vast consumer market, but also due to its manufacturing capabilities. As its infrastructure development nears completion, it will rival the best in the world. Coupled with its research and development prowess and a highly skilled, English-speaking workforce, India is well-positioned to outcompete China. The primary obstacle over the past two decades has been the West’s reluctance to consider India on par with China. This hesitation is now diminishing as China’s aggressive stance in the Pacific underscores the risks of over-reliance on a single country.

The U.S. administration has begun to recognize the need for alternatives to China, realizing that without them, a belligerent China could dominate the Pacific and undermine American influence. We are already seeing the early stages of this shift, with tariffs on Chinese goods, such as those imposed during the Trump administration and most recently on Chinese-made electric vehicles under President Biden. At the same time, significant progress has been made in curbing the theft of technology, a practice China has been notorious for. Consequently, China’s progress in high-end semiconductor manufacturing has been limited.

In conclusion, India is now a top priority for Western investment and manufacturing. With its high potential, all it needs is investment and technological support to become a global export leader.

www.visualcapitalist.com

www.visualcapitalist.com