The Guadalajara Design Center (GDC) has become an important asset within Intel's semiconductor development chain, providing talent and technology for their development and validation, as well as in the formation of a local ecosystem for new technologies.

Intel's center is mainly made up of two laboratories, one for research and development (R&D) around algorithms and technologies that may or may not reach the market, and another where validation of products that are already in their final stages for commercialization is carried out.

Intel Labs, one of the few laboratories of the company outside the United States and the only one in Latin America, carries out research work in Artificial Intelligence (AI), computer architecture and design, as well as silicon and system prototyping.

Although silicon or semiconductor is not manufactured in Mexico, Jesús Palomino, General Director of the GDC, explained that it participates in different parts of its development, such as the design of a piece or module in collaboration with other Intel research centers, and that it could ultimately be integrated into a future processor. Likewise, they collaborate in the development of the package, chassis, thermal system and final platform.

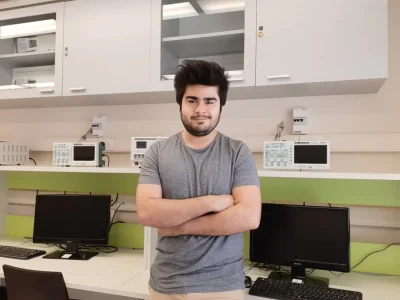

image 2

Jesús Palomino, director of the GDC. Photo: Efrén Páez

Palomino highlighted that they are also involved in the final integration of all the technologies involved such as the chipset, processor and memory developed around the world and that will be integrated into the final product. Next-generation computers are also integrated, which are used internally to perform the semiconductor validation tests.

In the R&D segment, solutions related to Artificial Intelligence (AI), autonomous systems and computing beyond the traditional are also investigated, such as Von Neumman architecture or neuromorphic and quantum processors.

Palomino highlighted the importance of talent in the center, as well as the open culture focused on fostering innovation. Currently, the GDC employs more than 1,800 engineers (700 were integrated in the last year), of which 24 percent have master's degrees and 4 percent have doctorates.

Additionally, the center has been involved in talent development programs, for example, through collaboration with 25 universities for the training of ambassadors and an innovation project through a network of 12 laboratories.

Palomino added that there are also diversity and inclusion initiatives, with the goal of doubling the number of women in leadership positions by 2030, and reaching a 40 percent representation of women in engineering positions.

The center has managed to present more than a thousand invention publications, with 189 patents already granted to the GDC and Intel.

Electrical validation of microprocessor designElectrical validation of microprocessor design

Microprocessor validation at scaleMicroprocessor validation at scale

Remote validation of microprocessor designRemote validation, microprocessor design

Mexico must take advantage of the current moment

Isaac Ávila, director of Government Relations for Intel Mexico, highlighted the role that the country and the rest of the region can play in Intel's new IDM 2.0 strategy.

Through this initiative, the company seeks to reduce the sector's dependence on Asian manufacturing, and increase the United States' share of chip manufacturing worldwide by up to 30 percent and Europe's by 20 percent.

You may be interested in: Chip manufacturers reduce investments due to lack of incentives in the United States

The executive considered that Mexico faces an important moment and opportunity to participate in a market that is estimated to generate revenues of more than 600 billion dollars by 2022. Intel estimates that in 2018, Mexico contributed 11.6 percent of the global semiconductor supply.

Among the main advantages of the country are its proximity to the North American market, a time zone in line with the north and south of the continent, cultural compatibility and multilingual technological talent.

However, he considered that in order to take advantage of this opportunity, "government support and cooperation are required, for the definition of vital issues and the development of initiatives that can have a positive impact."

He celebrated that in Mexico a collaboration agreement was recently signed with the Ministry of Economy and the industrial chambers for the development of specialized talent in the short and medium term, which will allow increasing the competitiveness of the country and help attract new investments in the sector.

“Intel's presence in different countries such as Colombia, Costa Rica and Brazil helps to strengthen the bloc and region, and we have to take advantage of these opportunities because this is the time to strengthen the supply chain.

El Guadalajara Design Center (GDC) se ha convertido en un activo importante dentro de la cadena de desarrollo de semiconductores de Intel, al aportar talento

dplnews.com

In 2025, Mexico will have its first plant of national origin for the manufacture of chips. That is the plan of QSM Semiconductores, a Mexican company that seeks to make available to the market its "first chips with the Made in Mexico seal."

According to Alejandro Franco, founder and CEO of the company, this advance will allow "Mexico to be placed" on the semiconductor map, thanks to chips designed by Mexican engineers at the company.

QSM plans to lay the first stone of its semiconductor manufacturing plant at the end of 2024, on land located in Querétaro, where its Engineering and Innovation Center and Integrated Circuit Design Center are also located.

Silicon Wafer 02

According to the company, the construction of this facility will take approximately one year, so it is possible that the manufacturing processes will begin at the end of 2025 or early 2026.

This factory is expected to produce 10,000 silicon wafers per year, the circular sheets on which most electronic devices are built, such as computer microprocessors or smartphone chips.

En 2025, México contará con su primera planta de origen nacional para la fabricación de chips. Ese es el plan de QSM Semiconductores, una empresa mexicana que...

www.xataka.com.mx

www.autotransporte.mx

www.autotransporte.mx

www.autotransporte.mx

www.autotransporte.mx