- Joined

- Jan 5, 2025

- Messages

- 153

- Likes

- 694

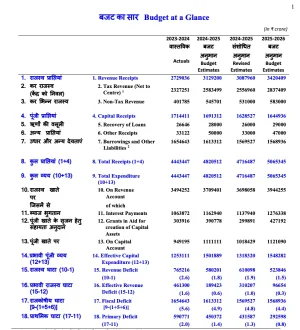

it's 12% increase in capex if forces manage to spend 1.8 lakh cr, forces have been able to spend 1.59 lakh crore current fiscal.

View attachment 23705

demand for grants is a bottom up process, all departments down the hierarchy give the number they think they will be able to spend and the final number goes to finance ministry for approval.

in the current fiscal, either some contracts that were scheduled to be signed did not happen, or delivery/payment did not happen yet.

Do we have service wise break-up of capital expenditure. Perticularly interested in IAF capital outlay.